The Bookkeeping Engine: How Bulletproof Records Directly Unlock $30K+ in California Tax Savings for 2025

The Bookkeeping Engine: How Bulletproof Records Directly Unlock $30K+ in California Tax Savings for 2025 Most California business owners and high-income earners fear an FTB or IRS audit — so they obsess over keeping receipts, or shrink from certain deductions, terrified they’ll trigger a penalty. Here’s the overlooked problem: the vast majority of business owners […]

Breaking the Cycle of Bookkeeping Mistakes: How California Business Owners Can Turn Compliance into Tax Savings in 2025

Breaking the Cycle of Bookkeeping Mistakes: How California Business Owners Can Turn Compliance into Tax Savings in 2025 There’s a persistent myth that bookkeeping is a menial administrative task—something to “get through” or delegate down the food chain. In California, this belief isn’t just wrong; it’s expensive. Year after year, small business owners, LLCs, and […]

Smart Tax Moves for Anaheim, CA Business Owners: 2025 Tactics No One Tells You

Smart Tax Moves for Anaheim, CA Business Owners: 2025 Tactics No One Tells You Most Anaheim business owners assume high taxes are inevitable—especially in California. That belief alone costs locals $13,200 per year in missed write-offs and compliance mistakes, based on 2024 IRS audit data. The right strategies—applied early and with precision—change everything. Two facts […]

Mission Viejo Tax Prep: 7 Deductions Most People Miss

Mission Viejo Tax Prep: 7 Deductions Most People Miss This information is current as of 9/22/2025. Tax laws change frequently. Verify updates with the IRS or FTB if reading this later. Quick Answer: What Most Mission Viejo Taxpayers Miss For the 2025 tax year, residents in Mission Viejo, California, often overlook local-specific deductions—especially those available […]

Why Anaheim Bookkeeping Services Are Saving Local Businesses $25K+ on Taxes in 2025

Why Anaheim Bookkeeping Services Are Saving Local Businesses $25K+ on Taxes in 2025 Most business owners in Anaheim dread audits or surprise tax bills—but it’s not high income that gets you in trouble. Nine out of ten IRS (and California FTB) headaches start with one thing: messy bookkeeping. The real risk isn’t how much you […]

The 2025 Guide to Tax Preparation in Irvine, CA: Hidden Deductions and Audit-Proof Moves for Every Persona

The 2025 Guide to Tax Preparation in Irvine, CA: Hidden Deductions and Audit-Proof Moves for Every Persona Irvine tax preparation isn’t about ticking boxes for the IRS. Every year, thousands in Orange County leave $4,000–$60,000 on the table, whether they’re W-2 employees at tech giants, 1099 consultants, LLC founders, or fast-growing property investors. The 2025 […]

The 2025 Newport Beach Advantage: Tax Prep Tactics for Top W-2 Earners and Real Estate Investors

The 2025 Newport Beach Advantage: Tax Prep Tactics for Top W-2 Earners and Real Estate Investors Most high-income Newport Beach residents assume tax prep is just a paperwork chore—send the docs, sign, and hope for the best. That passive approach is why so many smart people end up writing five- or even six-figure checks to […]

DIY vs Professional Bookkeeping for 1099s in California: Hidden Tax Risks and ROI

DIY vs Professional Bookkeeping for 1099s in California: Hidden Tax Risks and ROI Most California freelancers and independent contractors assume that doing their own books is “good enough” — until it’s not. Every year, thousands of 1099 earners in California accidentally miss $5,000, $15,000, even $40,000 in qualifying deductions, all while risking massive IRS penalties […]

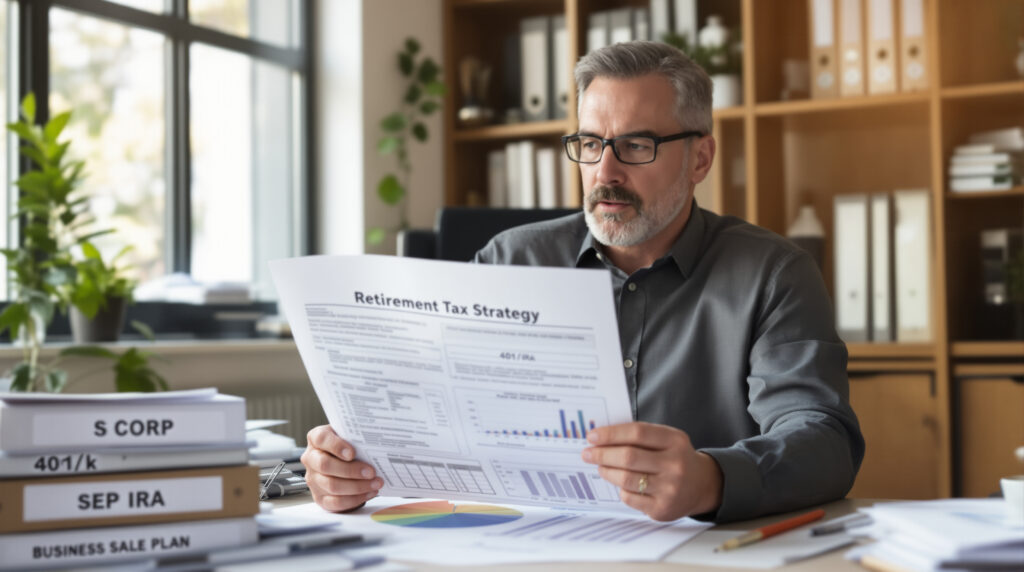

Retirement Tax Strategies for Business Owners: The Path to a $275K Tax-Free Exit

Retirement Tax Strategies for Business Owners: The Path to a $275K Tax-Free Exit Most business owners overpay six-figures in taxes the year they sell or retire—simply because nobody built them a tax exit plan. The myth? That all the real savings happen during your working years. The reality: the right sequence of retirement tax strategies, […]

California Estate Tax 2025: Advanced Playbook for High-Net-Worth Families to Preserve Wealth and Outsmart New Federal Deadlines

California Estate Tax 2025: Advanced Playbook for High-Net-Worth Families to Preserve Wealth and Outsmart New Federal Deadlines Most high-net-worth Californians believe they’re insulated from estate taxes because the state has “no estate tax.” This false sense of security is exactly why more intergenerational wealth is lost in California than almost anywhere—federal rules have quietly tightened, […]