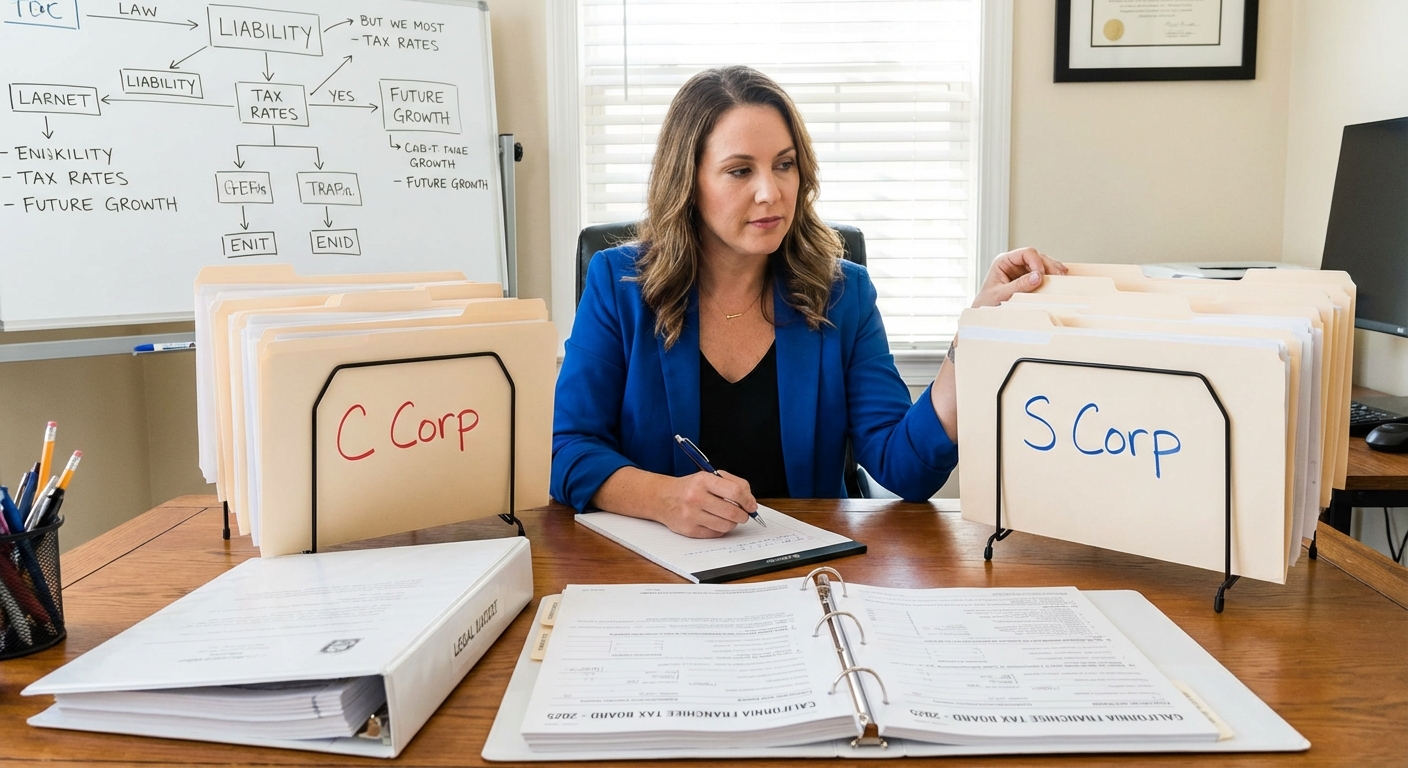

Why the “Difference Between C-Corp and S-Corp LegalZoom” Is a $25,000 Decision – Side-by-Side Breakdown for 2025

Business owners, consultants, and investors make one mistake over and over: trusting generic online comparisons instead of understanding the difference between c-corp and s-corp legalzoom rules in real-world dollars. It’s more than “taxed once vs. taxed twice” – and if you’re operating in California in 2025, a one-size-fits-most answer can easily cost you five figures a year.

Quick Answer: What’s the Difference in a Nutshell?

An S Corp lets business profits pass straight through to your personal tax return, so you avoid a second layer of corporate tax. A C Corp pays its own tax on profits, then you pay again if you take those profits out as dividends. But in 2025, state rules, pay structures, health insurance, and IRS compliance traps make this choice more strategic—and risky—than ever.

The real difference between c-corp and s-corp legalzoom comparisons fail to show is who pays tax, when, and at what combined rate in California. Federal pass-through treatment doesn’t eliminate California’s franchise tax, and C Corps are taxed even when owners take no money out. For owners earning over $150,000, this choice is less about structure labels and more about controlling payroll tax exposure versus double taxation. That’s where five-figure outcomes are decided.

The Real 2025 Stakes: Why LegalZoom Charts Mislead Smart Owners

Online summaries rarely tell you how those differences play out in actual numbers. For example, a California consultant with $225,000 in profit in 2025 faces:

- S Corp: Owner takes a $90,000 W-2 salary (reasonable for field), pays payroll taxes, and the remaining $135,000 is subject only to personal tax rates. FTB’s 1.5% California S Corp franchise tax applies to profit, costing $3,375.

- C Corp: Pays 8.84% California income tax on all $225,000, or $19,890. Then, when owner takes money out, they’re hit again—qualified dividends taxed up to 20% federal plus 13.3% California for high-income earners.

Comparing only the “legal entity” fee glosses over payroll complexity, corporate formalities, and the way California’s tax law punishes passive C Corp shareholders. LegalZoom’s entity setup chart won’t show you that running health insurance through a C Corp can tank deductibility if not structured right—but S Corps have their own IRS minefields.

Drilling Down: Payroll, Health, and 2025 California Compliance

Owners in both structures must deal with payroll—either to themselves (S Corp) or to staff (C Corp). In 2025, the IRS is doubling down on S Corp “reasonable salary” enforcement (see IRS Form 1120S rules). Underpay yourself and the IRS may reclassify distributions as wages, triggering back taxes and penalties.

Meanwhile, C Corp owners face the challenge of double taxation if they want to take profits out: once at the corporate level, again as a dividend. Some owners try to bypass this with fancy health benefit or fringe strategies—only to find out that California’s rules and federal ERISA guidance make many red-flag “write-offs” illegal unless executed perfectly.

If you’re wondering how this applies to the average LLC or multi-partner entity evaluating whether to “go S Corp,” now is the time to sharpen your decision criteria. Our business owner tax strategy solutions help real companies unravel this tangle before the first dollar is deposited.

KDA Case Study: S Corp Wins for Consultant, but C Corp Is a Trap for REI Group

Allen is a 1099 consultant in San Diego earning $220,000 per year via an LLC taxed as an S Corp. He used to be a sole proprietor, but after switching, his KDA team restructured his pay, set a W-2 of $80,000, and ran the rest as K-1 distributions. In 2024, he paid $7,800 in payroll tax, $1,800 in California S Corp franchise tax, and avoided $17,600 of self-employment tax. Total annual net tax savings: $13,900 after KDA’s $3,000 fee. ROI: 4.6x.

By contrast, KDA worked with a real estate investor group using a C Corp for short-term rentals. They faced an $8,000 annual California corporate tax bill just for “earning nothing,” plus double payroll on staff, losing out on the Section 199A deduction entirely. After converting to a pass-through S Corp/LLC structure, their tax bill dropped by $22,500 within the first filing year, even after our advisory fees.

Ready to see how we can help you? Explore more success stories on our case studies page to discover proven strategies that have saved our clients thousands in taxes.

Service Spotlight: S Corp and C Corp Entity Formation and Compliance

S Corp and C Corp formation isn’t just a paperwork choice—it’s a multiyear compliance relationship with the IRS and (in California) the Franchise Tax Board. Our entity formation and tax compliance solutions ensure you start right and avoid $10,000+ mistakes common with DIY setups or non-specialist attorneys. We set up formalities, customize payroll, and structure shareholder pay in line with the latest IRS and FTB scrutiny for 2025.

For deeper breakdowns of 2025’s S Corp strategy differences, see our Comprehensive S Corp Tax Guide.

Red Flag Alert: Common Misconceptions About S Corps and C Corps in 2025

Many “S Corp calculators” or summary blogs pretend as if the choice is all about federal taxes or withholdings. The reality in 2025:

- California’s 1.5% S Corp tax applies to ALL S Corps regardless of size (even side hustlers).

- C Corp owners can’t avoid double taxation by just paying themselves big salaries—there are IRS and FTB limits on what’s “reasonable,” and excessive pay gets flagged.

- Health benefits, meals, and retirement accounts have dramatically different rules inside a C Corp than a pass-through S Corp.

- Failing to properly issue K-1s or W-2s in an S Corp (or 1099s in a C Corp with contractors) means instant audit risk under new IRS enforcement initiatives.

Quick fix: If you’re not sure which path fits your income, employee structure, and benefits mix, stop using generic charts and get a California-specific breakdown based on this year’s laws.

Do S Corp and C Corp Owners Owe Different Taxes in California for 2025?

Yes. S Corps pay only the 1.5% franchise tax on net income (minimum $800), while C Corps pay the 8.84% corporate tax rate, even if the owners take zero salary. Then, if the C Corp owner takes profits out, personal taxes due on dividends add another layer—often pushing the effective California rate north of 20% for high earners when all taxes are stacked. S Corp owners dodge the double tax if they observe all payroll and compliance regulations.

What If I Have Multiple Owners or Investors?

An S Corp can have up to 100 shareholders (must be U.S. persons). A C Corp can have unlimited classes of stock and any type of owner—including other corporations or foreigners. But beware: S Corps restrict ownership tightly, and one mistake (like admitting a nonqualified shareholder) blows up your pass-through status, resulting in a costly conversion to C Corp—with retroactive tax implications.

What Paperwork Does the IRS Require for S Corp vs. C Corp?

A C Corp files Form 1120 each year. An S Corp files Form 1120S plus K-1s for each shareholder. Both entities need formal annual meetings, recorded minutes, shareholder resolutions for key decisions, and detailed payroll tracking. California also requires separate annual filings (such as Form 100 for C Corps and Form 100S for S Corps) and stringent franchise tax compliance for both.

Fast Tax Fact: When Does S Corp Make Sense for a 1099, LLC, or Solo Owner?

If your net profit (after expenses) is over $80,000 and you want to avoid self-employment tax on every dollar, an S Corp can put $7,500–$15,000 per year back in your pocket. C Corp only makes sense for high-growth startups planning to raise capital, issue stock, or reinvest all profits (and willing to hire separate payroll/HR firms to avoid compliance pitfalls).

Pro Tip: See the Actual Take-Home Banality With a Tax Calculator

If you want to see how your business profits stack up under each structure after taxes, payroll, and California add-ons, use a tool like the small business tax calculator to model your real distribution numbers before you file or restructure.

FAQ: C Corp vs. S Corp Nuances for California in 2025

Can S Corp Owners Deduct Health Insurance?

Yes—but the premiums must be added to your W-2 as income, and you must meet all IRS requirements under Publication 535. C Corp owners may deduct premiums at the corporate level, but benefits may be taxable to certain shareholder-employees or subject to ACA discrimination testing.

Are S Corps or C Corps Harder to Audit?

In general, S Corps flagged for payroll errors or “unreasonable compensation” audits have risen over 20% year-over-year since 2022 (IRS data). C Corps face major audit risk if they mischaracterize salary vs. dividends, especially with the FTB scrutinizing high-comp borrowers and related-party loans.

Do I Need Both? Dual Entity Strategies for Advanced Owners

Some complex groups operate C Corps and S Corps together to balance liability, branding, or passive/active income for capital partners. Each layer adds paperwork, fees, and compliance headaches but can make sense in five-figure income or multi-entity investment scenarios. Always build these plans with entity experts and California-focused tax pros first.

Bottom Line

Online entity decision tools like what you’ll find at LegalZoom don’t reveal the actual tax stakes for California owners in 2025. Get a custom breakdown for your numbers—the right structure saves $15,000–$25,000 a year, and the wrong call drags in hidden taxes, fees, and audit risk for years.

This information is current as of 1/3/2026. Tax laws change frequently. Verify updates with the IRS or FTB if reading this later.

Book Your 2025 Entity Decision Strategy Session

If you’re weighing S Corp vs. C Corp for your business, don’t risk a five-figure tax mistake this year. Book your custom entity review with KDA’s expert team for a dollar-by-dollar analysis, California FTB risk assessment, and a step-by-step roadmap to a tax-efficient, audit-proof operation. Click here to secure your 2025 strategy session.