What C Corp vs S Corp Means for California Owners in 2026: The Tax Reality Most Still Get Wrong

This year, thousands of California business owners will make (or ignore) a single entity decision that could shift their tax bill by $35,000 or more. Most don’t realize the stakes or let their CPA pick for them—never questioning if it matches their cash needs, capital goals, or IRS risk profile. Let’s break down what C Corp vs S Corp means in 2026, who wins (and loses) under each, and why the path you choose next could lock in—or cost—you six-figure savings.

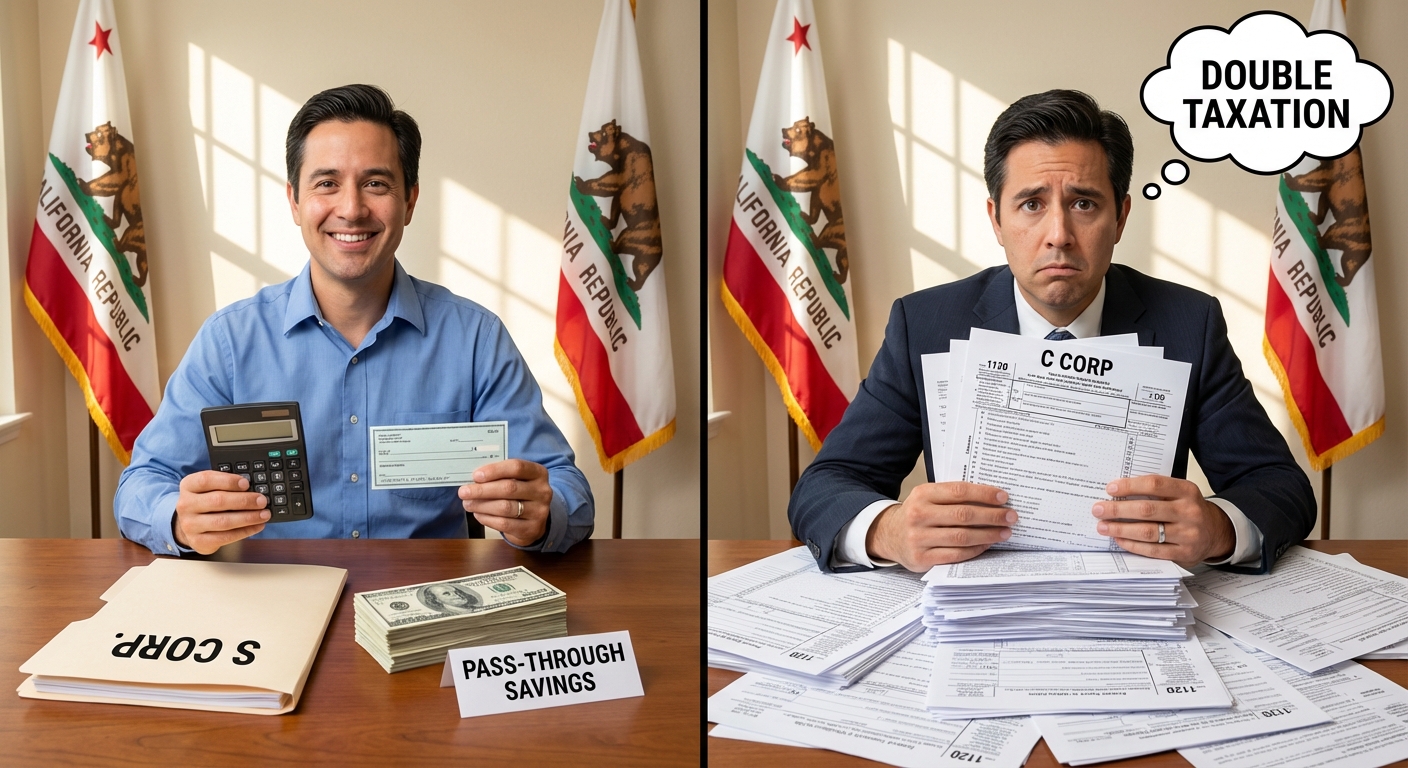

Quick Answer: The Real Difference (And What’s At Stake)

S Corps are pass-through entities where profits flow directly to owners and get taxed only once—on your personal return—while C Corps pay corporate tax, then owners pay personal tax again on dividends. That difference alone can swing your after-tax cash by $20,000–$60,000 a year for profitable California businesses. For 2026, IRS audits are up, compliance rules are stricter, and state penalties for misclassification are among the nation’s steepest. Whichever you pick, the cost of getting it wrong is higher than ever (see our S Corp tax guide for the comprehensive breakdown).

How S Corps and C Corps Really Work (With Examples)

Let’s get specific about structure, requirements, and money flow—a crucial step too many business owners gloss over. Here’s how each works, using real numbers and consequences:

- S Corporation: A pass-through entity. The company files Form 1120S, pays no federal income tax, and the profit “passes through” to owners (on Schedule K-1) for reporting on their personal 1040. Owners pay tax once—at ordinary income or capital gains rates.

- C Corporation: A separate taxable entity. The company files Form 1120, pays federal income tax (21% for 2026), then pays dividends to owners, who report this again on their 1040 and are taxed a second time (typically 15–23.8% federal, plus California state).

Example: If a California tech consultant nets $300,000 after expenses:

- S Corp: Let’s say the owner pays themselves a $120,000 “reasonable salary” (subject to payroll and income taxes) and distributes the $180,000 remaining profit. The owner pays federal and CA tax on all of it, but avoids 15.3% self-employment tax on the distribution. Total effective tax: ~$95,000. Net after tax: ~$205,000.

- C Corp: The company pays 21% corporate tax ($63,000) on $300,000, leaving $237,000. If it’s all paid as dividends, the owner pays up to 37.1% (top federal + CA) on the $237,000 (another ~$87,900). Total effective tax: $63K + $87.9K = $150,900. Net after tax: ~$149,100. That’s a $55,900 difference—every single year.

Documentation, compliance filings, and who can own shares also differ dramatically. For a complete breakdown of S Corp strategies, see our comprehensive S Corp tax guide.

KDA Case Study: Professional Services Firm Dodges $33K in Double Taxation

Michelle is a California marketing consultant grossing $420,000 annually, operating as a single-member LLC taxed as a C Corp. She once thought leaving profits in the business would shield her from high personal tax, based on old advice. After working with KDA, we showed her that—under 2026 law—California’s 8.84% state corporate tax, plus federal double tax, meant she was paying nearly $54,000 more per year than she would as an S Corp. By modeling both operations, we restructured her LLC to file Form 2553 (S Corp election), set a compliant salary, and mapped her profit split. In year one, she paid herself $140,000 salary, distributed $210,000, and slashed combined taxes from $186,500 (C Corp) to $153,500 (S Corp)—a $33,000 savings. Total KDA fee was $4,500, for a 7.3x first-year ROI. That change is permanent unless the IRS changes her status.

Ready to see how we can help you? Explore more success stories on our case studies page to discover proven strategies that have saved our clients thousands in taxes.

Who Should Choose S Corp vs C Corp in 2026?

Your optimal pick comes down to real income, reinvestment needs, and personal withdrawal plans. Here’s who typically benefits most:

- S Corp works best for:

- Active business owners taking large distributions ($60,000+ per year)

- 1099 contractors, solo LLCs, and partnerships seeking payroll tax savings

- Professional service firms, real estate agents, medical and legal practices

- C Corp works best for:

- High-growth startups raising outside equity or issuing multiple stock classes

- Owners wanting to retain profits inside the business and defer payouts

- Foreign owners (non-US citizens/residents can only own C Corp shares)

For business owners, especially those outside the startup or VC ecosystem, the S Corp election is usually a better fit. KDA’s entity formation services can walk you through the IRS and California forms, step-by-step.

Red Flags and Costly Mistakes: Why Most Owners Regret Their First Entity Pick

The most common trap is letting your accountant “default” you into one box just because it seems easy or someone else did it. Here’s what goes wrong:

- Profit Levels Change: What worked for a $70,000 business can destroy value at $400,000. You must model different profit scenarios and re-evaluate every 2 years.

- Double Taxation Surprise: Too many C Corp owners pull all business profits out as dividends, thinking only about federal tax, and miss that California state also bites above 8%. That’s a $10,000–$40,000 surprise for many who could switch to S Corp and just payroll the amount needed for compliance.

- S Corp Ownership Rules: S Corps allow only US citizen/resident shareholders (up to 100), all individuals—not partnerships or foreign owners. If you violate this, the IRS can revoke S status retroactively, leaving you exposed to C Corp back taxes plus interest and penalties (see IRS S corporation eligibility rules).

- Compliance Deadlines: S Corp election (Form 2553) must be filed within 2 months and 15 days after the start of your tax year for the change to count. Miss it, and you’ll be stuck as a C Corp/LLC for another full year—no do-overs.

Pro Tip: Always re-assess your entity after hitting $80,000–$100,000 in profit—this is the “crossroads” where S Corp typically overtakes LLC or C Corp for most solo owners in real dollars saved.

FAQ: Your C Corp vs S Corp Questions Answered

Can I switch from C Corp to S Corp (or vice versa) mid-year?

No, S Corp status takes effect for the entire tax year only if you file Form 2553 on time. If late, it applies the following year. C Corp can be “dropped” voluntarily but comes with IRS scrutiny—always model the post-change income or losses first. See IRS Form 2553 for details.

Do S Corps really lower my self-employment tax?

Yes—S Corp owners pay payroll taxes only on their salary, not on profits above that. For example, paying yourself $90,000 and distributing $110,000 as profit avoids 15.3% tax on that $110,000—that’s $16,830 in savings every year.

Is there a California-specific catch for S Corps?

Yes. S Corps pay an annual 1.5% California franchise tax on net income (minimum $800/year), but this is usually a fraction of what you’d lose to double taxation under a C Corp for profitable, cash-focused businesses.

Can foreign owners or complex investors pick S Corp?

No. S Corps are strictly for individuals, US citizens/residents, single class of stock, and no outside partnerships or corporations. If you need outside investment, C Corp is usually required. For more, see this small business tax calculator to model your scenario.

What the IRS and California Audit Teams Are Looking for in 2026

Both the IRS and California Franchise Tax Board are increasing audit scrutiny on entity misclassification, especially when salary or profit splits don’t match market reality, or the wrong tax forms are filed. Examples:

- S Corp owners paying themselves below-market salaries as a workaround—IRS and FTB may “reclassify” distributions as wages, adding back payroll tax ($10K–$50K bill possible)

- C Corp owners using personal assets as business deductions, or failing to report dividends/distributions properly

For 2026, expect more notices and demand for supporting docs—especially with new IRS funding targeting small business audits. For full-service compliance, see our premium advisory services that cover IRS and California requirements, filings, and defense.

Comparison Table: S Corp vs C Corp at a Glance

| Factor | S Corp | C Corp |

|---|---|---|

| Federal Tax Rate | Personal bracket (up to 37%) | 21% corporate + dividend tax (up to 23.8%) |

| California Tax | 1.5% of net income (min $800/year) | 8.84% corporate + personal if dividends |

| Payroll Taxes | On owner’s salary only | On all wages paid out |

| Profit Withdrawal | Much easier, direct to owner via distribution | Limited by dividend policy and retained earnings rules |

| Ownership Restrictions | US individuals, 100 or fewer, 1 class of stock | None—can have multiple classes, foreign shareholders, VCs |

| Audit Risk | Salaries too low or noncompliant splits | Failure to report/withhold, improper deductions |

What If My Business Changes?

If your business evolves—new investors, big income swings, or you’re planning to sell—re-evaluate your entity choice yearly. The IRS allows some late elections (with reasonable cause), but proving your case takes time and documentation. Don’t delay—model your tax math now, and keep a written rationale for your CPA and records.

2026 Entity Strategy Checklist for California Owners

- Estimate your business profit and personal cash needs for the year

- Use the small business tax calculator for S vs C Corp projections

- Check eligibility for S Corp election (citizenship, stock class, shareholder count)

- Analyze state/federal tax (including the impact of CA 1.5% and double taxation)

- Decide—do you want to reinvest profits or withdraw them? How soon will you need the cash?

- Document your salary/distribution plan (S Corp)

- File correct forms by deadline (Form 2553 for S Corp; 1120 or 1120S for annual returns)

Key Takeaway: The difference between S Corp and C Corp is not just paperwork—it is a permanent fork in your tax journey. Model your scenario now, or risk five-figure losses you can never recoup.

FAQ Recap: What Most Owners Still Get Wrong

Is it easier to sell my company as a C Corp or S Corp?

C Corps are favored for VC-backed, high-value exits, but S Corps are usually better for main street businesses planning an asset sale—the tax math is friendlier at the individual level.

Can I “go back” if I pick wrong?

With IRS permission and good cause, yes—but it’s slow, risky, and you’ll likely forfeit losses built up under the “wrong” entity. Fix it before you’re profitable, not after.

How often should I re-evaluate my entity?

Every time your revenue jumps by $100,000, you change your growth plan, or you bring on new investors/owners. Annual review is best practice, especially in California where FTB penalties can get severe if you misclassify.

This information is current as of 2/15/2026. Tax laws change frequently. Verify updates with the IRS or FTB if reading this later.

Book Your 2026 Entity Optimization Session

If you’re not 100% confident your business is structured for the lowest possible taxes, it’s time for a real assessment. Book a strategy session with a KDA expert and get a personalized analysis, actionable entity plan, and ongoing support to keep your hard-earned profit. Click here to get your custom entity strategy now.