The Truth About Late Election for S Corp Status: Last-Chance Strategies That Actually Work in 2026

This information is current as of 2/18/2026. Tax laws change frequently. Verify updates with the IRS or FTB if reading this later.

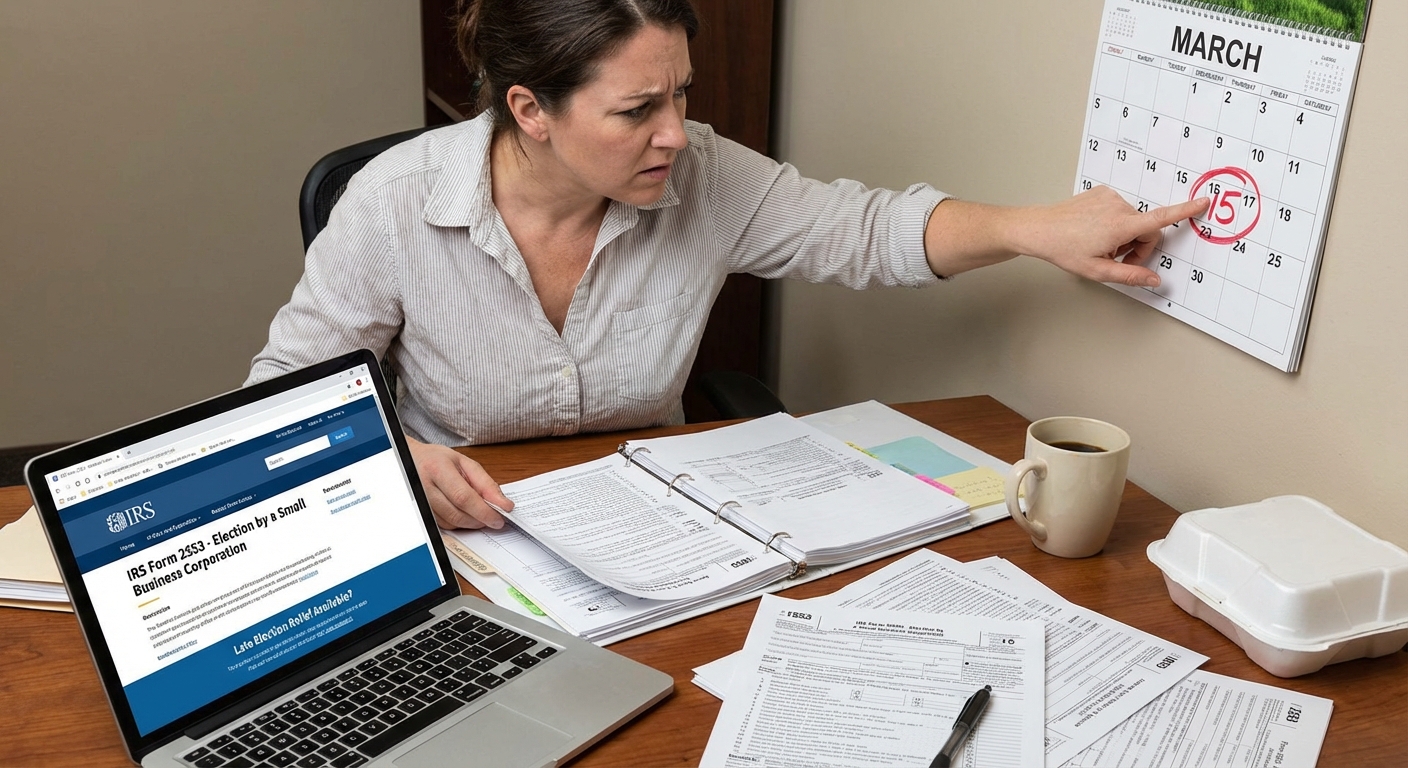

Missed the S Corp election deadline? You’re not alone. Each year, thousands of entrepreneurs, LLC owners, and even seasoned professionals realize—sometimes months later—that they didn’t file their S Corp election on time. The result? Potentially tens of thousands in lost tax savings, not to mention panic about backdated payrolls, IRS scrutiny, or state-level headaches.

Quick Answer

If you miss the S Corp election deadline (generally March 15 for current year status), the IRS does allow relief under certain late election procedures. You can often still qualify for S Corp tax treatment if you act fast, provide required statements, and meet the strict eligibility rules. But it’s not a “free pass”—documentation and compliance must be flawless. See IRS instructions for Form 2553 for details.

Why a Late Election Matters: Real Cost of Missing the S Corp Window

Most business owners don’t realize just how much a late election for S Corp status can reduce their tax bill—if done correctly. For a typical consultant earning $150,000 in CA, failing to elect S Corp status can mean paying $21,825 in unnecessary self-employment tax (15.3% of all net profit). If you missed the window but act quickly, this can often be fixed, saving five figures in taxes every single year.

The “late election” option exists for a reason: the IRS knows paperwork falls through the cracks for thousands of new and growing businesses. But you must understand the rules, eligibility, and red flags.

Who Qualifies for Late S Corp Election Relief in 2026?

Here are the eligibility rules for late S Corp election relief according to IRS Form 2553 guidance:

- Business must have intended to be taxed as an S Corp as of January 1 of the year in question, but failed to file Form 2553 on time.

- Owners/shareholders must have reported income as if the entity was an S Corp on all tax returns filed since that year.

- No ineligible shareholders (no C Corps, partnerships, or foreign owners).

- All required consents and signatures must be attached.

- A reasonable cause statement must accompany the late Form 2553 explaining why it was not filed on time.

For full rules and details about the relief provisions, the IRS refers specifically to Rev. Proc. 2013-30.

If you’re an LLC owner considering S Corp status, understanding these requirements is critical. Most business owners aren’t aware the solution exists until after the window has closed—and often their CPAs don’t warn them of the late relief process until it’s too late to fix.

KDA Case Study: Business Owner Recovers $14,200 After Late S Corp Election

Let’s be direct: Most firms never share real examples, but here’s what late relief really looks like. In 2025, “Nathan,” a 1099 marketing consultant from San Diego, operated his LLC for three years with rising profit ($140,000 in 2024). In early March, he realized he hadn’t elected S Corp status—missing the deadline by three weeks. Panic set in, but our team stepped in fast. We gathered his records, prepared Form 2553 with a detailed reasonable cause letter (showing intent to operate as an S Corp, consistent W-2s, and signed owner consent). Within 10 weeks, the IRS granted retroactive S Corp status, allowing Nathan to save $10,782 in self-employment tax, plus $3,400 in additional QBI deductions versus his old setup. His investment with KDA: $4,100. First-year ROI after professional fees: 3.4x, with ongoing savings locked in for each future year.

Ready to see how we can help you? Explore more success stories on our case studies page to discover proven strategies that have saved our clients thousands in taxes.

How to File a Late S Corp Election: Step-by-Step Guide

Don’t rely on wishful thinking or generic CPA templates—the IRS is looking for clear evidence that you intended to be taxed as an S Corp. Here’s how to get it right in 2026:

- Download the latest Form 2553 from the IRS website.

- Prepare a thorough reasonable cause statement. Lay out why the election wasn’t filed on time—staff turnover, misunderstanding of requirements, honest error in CPA communication. (Keep it honest but professional)

- Get written consents from all shareholders (if not a single-member LLC) using the signature block on Form 2553.

- Attach proof of intent. This could include emails with your CPA about payroll setup, board resolutions referencing S Corp status, or other records you acted consistent with S Corp treatment.

- Ship by certified mail and save all tracking records. Late elections are rare enough that you want indisputable evidence of submission and delivery.

Strategic year-end moves can save thousands. Our tax planning services help identify opportunities to secure the right entity status and catch any red-flag issues before they multiply.

For a complete breakdown of S Corp strategies, see our comprehensive S Corp tax guide.

What Documents Do You Need?

- Signed and completed 2553 (all owners must sign)

- Completed reasonable cause statement (attach separate sheet if necessary)

- Any prior year tax filings demonstrating S Corp intent (W-2s, payroll documents)

- CPA/bank correspondence (if used as evidence of intent)

Red Flag Alert: S Corp Late Election Traps Most Owners Miss

Common mistake: Owners file Form 2553 late WITHOUT a cause statement or inconsistent records—then get a letter back months later: “Election denied.” If the IRS suspects you purposely delayed or backdated records, they’ll refuse S Corp treatment, and you could face accuracy-related penalties under Section 6662(a).

Another trap: Failing to retroactively run payroll for the prior year. If your election is approved but you didn’t issue W-2s to yourself for the retroactive year, you may owe “reasonable compensation” back wages, plus interest and employment taxes. Always plan for catch-up payroll filings if needed.

Red Flag Alert: Don’t skip state-level forms. In California, failing to align your S Corp election with Franchise Tax Board filings can trigger thousands in penalties. Reference FTB Form 100S for state recognition of S Corp status.

Pro Tip

Include backup showing proactive steps: Dated payroll service enrollment, CPA email chains, and draft S Corp meeting minutes all help prove intent.

Scenario Breakdown: How Savings Stack Up Across Taxpayer Personas

- W-2 Employees considering side businesses: If your LLC side hustle clears $60K/year, electing S Corp—even late—usually saves $4,800–$7,300 annually over Schedule C status.

- 1099 Contractors: Switching from 1099/sole prop to S Corp status (with late election relief) typically saves $8,500–$13,200/year in self-employment tax if you pay yourself a $50,000 salary from $120,000 net profits.

- Real Estate Agents/Flippers: Can see five-figure savings when using late election after flipping a high-profit property or a surging commission year.

- Established LLCs moving to S Corp status: Multiyear elections/retroactive elections require careful alignment on all filings or IRS will deny relief—get expert guidance.

FAQs: Late S Corp Election

What is considered “reasonable cause” for a late S Corp election?

Reasonable cause is any legitimate, truthful reason you missed the deadline, such as misunderstanding of the law, CPA mistakes, clerical error, or health/personal emergencies. The IRS wants to see honest mistakes, not pattern abuse. Attach a written explanation to Form 2553—don’t overthink, but don’t omit.

How late is “too late” for making an S Corp election?

If you file your late election within 3 years and 75 days of the effective date, eligibility relief under Rev. Proc. 2013-30 typically applies. Beyond that, only special IRS relief is possible—and is much harder to get.

Will I Face IRS Penalties?

If you meet the requirements and act in good faith, you’re often granted relief. However, missing W-2 filings and failing to align tax returns can trigger payroll penalties, late filing fines, or denial of S Corp treatment altogether.

What About State Requirements?

California and other states often require separate S Corp notices and forms—if you don’t file the corresponding FTB or state-level documents, you could lose state-level S Corp benefits or receive notices demanding C Corp filings and taxes owed.

How Long Does the Relief Process Take?

Expect a 2-3 month IRS wait on late Form 2553 filings. In urgent cases (e.g., big tax penalty at stake), you can file with a request for expedited handling, though there’s no guarantee from the IRS timeline.

Can I Do This Without a Tax Pro?

Technically, yes. But the risk of IRS denial is high if you don’t understand what documents and timelines are needed. Consult a strategist—KDA fixes late elections for dozens of business owners every year.

Common Follow-Up Questions

Can a C Corp use late election to become an S Corp?

Yes, if all eligibility rules are met and C Corp was otherwise qualified for S Corp treatment, late election procedures can apply. But extra steps and shareholder consent are required.

What if I already filed as a sole proprietor?

You’ll generally need to file as an LLC or C Corp first. Late S Corp election relief isn’t available for sole proprietors—only for corporations meeting S Corp criteria.

The IRS Isn’t Hiding This Rule—You Just Weren’t Taught How to Use It

If 2025 was the year you planned to start saving big as an S Corp but missed the window, you don’t have to accept the penalty. With the right documentation, expert strategy, and proactive filing, late S Corp election can rescue your tax savings—and protect you from headaches down the road.

Book Your Tax Strategy Session

If you missed the S Corp window or are worried your election wasn’t filed right, don’t risk an audit or big penalties. Book a personal strategy session now and discover how to legally fix late elections, align your payroll, and secure every tax savings you deserve. Click here to book your consultation now.