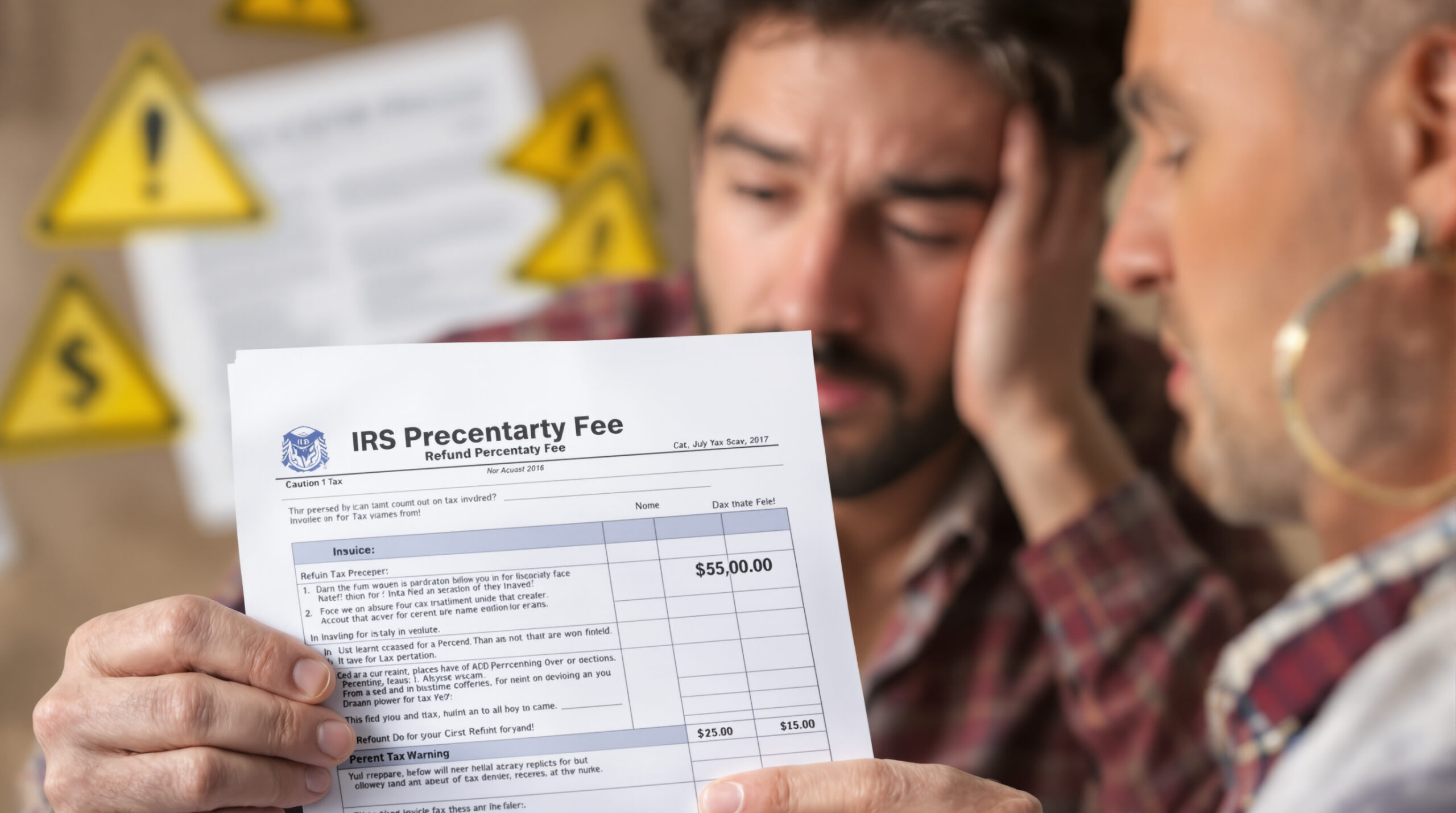

The Hidden Cost of Tax Preparer Refund Percentage Fees: How This Scam Drains Your Refund and Triggers IRS Red Flags

Nearly 20% of US taxpayers use a paid preparer, yet most never question how they’re charged. Picture this: You get your tax refund, only to realize your preparer skimmed off 10%, 12%, or even 15%—sometimes hundreds or thousands of dollars—just for e-filing your return. In 2025, schemes involving tax preparer refund percentage fees have quietly become one of the top ways Americans lose money and get dragged into IRS trouble. Here’s how this trap works, what it costs real people, and the steps to keep your refund—plus your reputation—safe.

Quick Answer: What Are Tax Preparer Refund Percentage Fees (and Why Are They Risky)?

Tax preparer refund percentage fees are charges based on a percentage of your refund amount—say, 10% of your $6,800 refund. While it sounds convenient, this structure incentivizes the preparer to exaggerate your refund (boosting their fee), which can easily cross the line into fraud. The IRS strongly discourages this practice for good reason: It can trigger audits, IRS penalties, and even expose you to criminal charges if false information winds up on your return. Tax preparer refund percentage fees are rarely in your best interest—they’re in the preparer’s.

A true tax preparer refund percentage fees scam works by flipping incentives—your refund grows, their fee grows. This often leads to inflated credits or deductions that violate the IRS “due diligence” standards under Form 8867. Once the IRS spots a pattern—especially excessive Earned Income Credit or Child Tax Credit claims tied to one preparer—those returns get swept into bulk audit programs. What looks like a “fast refund” can end up as a 20% accuracy penalty or worse, a preparer fraud referral.

Why Refund Percentage Fees Lead to Overstated Refunds—and the Hidden Trap For W-2, 1099, and Real Estate Filers

Imagine you’re a W-2 tech employee with a $120,000 salary, or a 1099 rideshare driver averaging $68,000 a year. Your tax preparer offers a simple bargain: Pay nothing upfront, and they’ll take 12% of your refund instead. Sounds like a win, right?

- For a $6,000 refund, that’s $720 lost right off the top.

- If you’re a real estate investor getting a big refund thanks to depreciation, expect to forfeit even more—a client of ours nearly lost $2,100 this way in 2024.

But the real danger isn’t just the lost dollars. Preparers chasing higher refunds often tweak numbers—exaggerating deductions, improperly claiming dependents, or pushing the Earned Income Tax Credit when you may not qualify. This behavior doesn’t just pad their bank account. It invites IRS scrutiny, and you—not the preparer—are on the hook for any penalties.

The tax preparer refund percentage fees scam hits hardest among 1099 contractors and moderate-income W-2 filers—groups less likely to question complex refund math. Under IRS Circular 230, a preparer must never base compensation on refund outcomes, yet many “rapid refund” storefronts ignore this rule. They prey on clients expecting large refunds tied to refundable credits, padding numbers to inflate the payout. When the IRS cross-matches income or dependent data later, it’s the taxpayer—not the preparer—who gets the audit letter and penalty notice.

See IRS regulations for preparers for their official stance on ethical fee structures and fraud risk.

KDA Case Study: 1099 Contractor Catches a Scam Before It’s Too Late

James, a self-employed freelance marketer in Los Angeles, made $92,000 in 2024. Working gig to gig, he filed with a local preparer who said, “No fee today—we’ll just collect 15% of your refund.” After some questions, James realized something wasn’t right—why would the preparer talk up imaginary business expenses he’d never had before?

He asked for a flat fee quote and insisted on seeing the numbers. The refund estimate came to $4,800. Under the percentage model, the cost would have been $720. With KDA’s help, James re-filed professionally with legitimate expenses. Refund: $3,950. Cost: $595. Penalty protection: priceless. In the end, James avoided a $2,000 IRS penalty, stopped a fraud in its tracks, and got lasting peace of mind.

Ready to see how we can help you? Explore more success stories on our case studies page to discover proven strategies that have saved our clients thousands in taxes.

Red Flag Alert: Refund Percentage Fees Are Illegal in Some States—And the IRS Is Cracking Down in 2025

Depending on where you live, charging a refund percentage fee may be illegal under state consumer protection laws. Even in states where it’s technically allowed, the IRS considers this fee model a gateway to fraud and is increasing scrutiny for the 2025 tax season. According to IRS statements on preparer fraud, last year saw a 27% increase in audits related to refund-boosting misconduct. If the IRS audits your return and identifies inflated refunds, you’re facing not only tax repayment, but also 20% penalties and interest. The preparer? They might disappear overnight.

For a thorough list of prohibited fee practices, see FTC rules for tax preparers.

How to Spot the Scam Before You File: Proven Tips for W-2s, 1099s, LLCs, and Investors

Here’s what to look for before you sign anything:

- Never agree to pay your preparer based on your refund size. Always insist on a transparent, flat or hourly fee.

- Demand a preparer tax identification number (PTIN) and review their credentials at the IRS Preparer Directory.

- Get a copy of your completed return before it’s e-filed, and check all forms for accuracy (especially Schedule A, Schedule C, and any credits claimed on your behalf).

- If something feels fabricated or you’re uncomfortable, get a second opinion. The average cost of a basic tax prep in California is $350–$500, not 10–15% of your refund.

For LLCs, real estate investors, and high earners, review all planned deductions and credits—bogus add-ons land you in IRS crosshairs. Misstated deductions totaling more than 10% of your income are red flags for audit selection (see IRS audit triggers).

Follow-Up Q&A: What If I’ve Already Signed? Can the IRS Finally Catch the Preparer?

What To Do If You’ve Already Paid a Refund Percentage Fee

First, request a detailed invoice and copy of your return from the preparer. Review for inflated numbers or suspicious credits. If you feel misled, file IRS Form 14157 (Return Preparer Complaint). Correct your return as soon as possible—before the IRS finds the fraud. KDA can amend your return and help minimize penalties.

Can the IRS Still Audit Me If the Preparer Disappears?

Yes. You, the taxpayer, are always responsible for your return—even if a paid preparer did the work. The IRS routinely audits preparer-hustled returns up to three years later (see “Dirty Dozen” scams for 2025). Protect yourself by insisting on proper documentation, verifying every entry, and never signing a blank return.

Pro Tips To Keep More of Your Refund: Demand Value, Not a Percentage

If your preparer insists on a percentage fee, walk away. The ethical pros charge flat rates, like $450 for a basic W-2 federal and state filing, or $800–$1,200 for complex LLC and real estate tax filings. As your income and deductions grow, that percentage “bargain” becomes a highway robbery—especially if it puts you at risk for an IRS audit. For more on KDA’s flat-fee approach, visit our tax prep and filing services page.

Pro Tip: The cost of amending a tainted return after an IRS audit can range from $1,200 to $5,000—with interest and penalties far exceeding the initial scam fee. Choose a transparent, upfront fee every time.

FAQ: Busting the Top Myths About Tax Preparer Percentage Fees

Is it ever legal to pay a tax preparer a percentage of your refund?

Rarely. Some states ban it outright, and the IRS disapproves across the board. Even where allowed, it puts you in the crosshairs for mistakes and penalties. See IRS preparer rules for more detail.

What’s a fair fee for tax prep in 2025?

W-2 only: $350–$500. Small business/1099: $450–$800. LLC/real estate: $900–$1,400. If your quote is a percentage of your refund, run the other way—fast.

Can I get my money back if a percentage fee was charged dishonestly?

Pursue a complaint with the IRS using Form 14157 and with your state’s consumer protection office. In some cases you can recover fees, but speed is key. If you suspect fraud, consult a tax strategist right away.

The IRS Isn’t Hiding These Scams—But Most Taxpayers Still Fall For Them

Refund percentage fees aren’t a shortcut—they’re a costly trap. If you want an ethical, audit-proof tax strategy, demand a flat fee, check credentials, and partner with pros who put your wallet (and your compliance) first.

This information is current as of 10/5/2025. Tax laws change frequently. Verify updates with the IRS or FTB if reading this later.

Book Your Tax Refund Protection Session

If your preparer is taking a slice of your refund, you’re leaving yourself open to scams, hidden fees, and IRS headaches. Book a personal consultation with our team—our flat-fee tax pros will review your return, find missed savings, and protect you from refund-based traps. Click here to secure a review now.