Tax season is here! Right now, you’re probably wondering how you can save the most money on taxes possible this tax season. That’s why I created this blog post. Once you read this blog post, you will understand the difference between tax reduction and tax compliance and know how to save the maximum amount of money on taxes!

Who Is Kenneth Dennis?

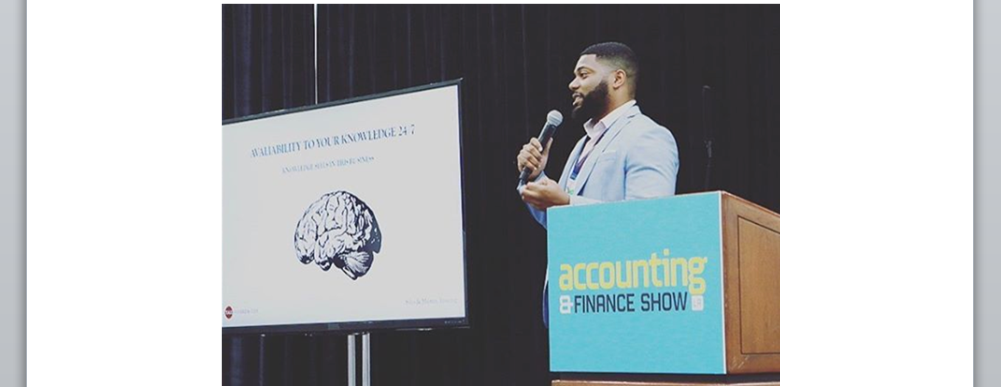

First and foremost, who am I, and why should you listen to me? I am Kenneth Dennis, son of Karla Dennis and founder of Tax Reduction Company.

A few years ago, I realized I could use my marketing skills and my mother’s accounting background to create a platform to help the little man save on taxes.

Together with my mother, I launched Tax Reduction Company. A company with a mission to help hard-working Americans save thousands on taxes.

Last year alone, we helped many Americans save six figures or more on taxes.

This year we plan to do even more to help you achieve a less taxing life by providing educational content like this.

What Is Tax Compliance?

As you know, our government has rules for how you can file taxes as a business or as an individual. As a taxpayer, there are state, federal, and international tax laws you must follow promptly to avoid any penalties.

The tax laws you must follow can vary depending on where you live and where you do business. But, overall, tax laws are in place to ensure everyone pays their taxes to support our local and federal government.

While that sounds simple, staying compliant with tax laws can be challenging when the laws constantly change.

This is why many individuals and businesses hire CPAs to help them file their taxes without unknowingly breaking tax laws. After all, breaking tax law is a form of non-compliance that often leads to fines or penalties.

What Is Tax Reduction?

Tax reduction is a process of lowering how much you must pay in taxes. Essentially, you are reducing your tax liability by using tax deductions and tax credits.

You should know that not every tax law is the end all be all. Some laws have different requirements that allow you to avoid following them.

Hence, you can avoid paying certain taxes if you meet specific conditions.

In addition, there are tax laws that are in place specifically to allow you to receive tax breaks.

Introducing: The Tax Reduction Program

Even though federal taxes has existed for hundreds of years, millions of Americans still overpay in taxes. This is due to them not having access to all the tax strategies available.

For many Americans, just remaining tax compliant is already very difficult, so being able to write off taxes and remain tax compliant is even harder.

That’s why I created The Tax Reduction Program. This program leverages Karla’s 15+ years of knowledge as a tax strategist to teach you how to pay less in taxes.

It puts powerful tax-saving strategies in the hands of small business owners, independent contractors, and W2 employees.

This program allows entrepreneurs to use the tax code to achieve their dreams.

It also gives your everyday American more money to spend on things like providing for their family.

You can learn more about The Tax Reduction Program by clicking here.