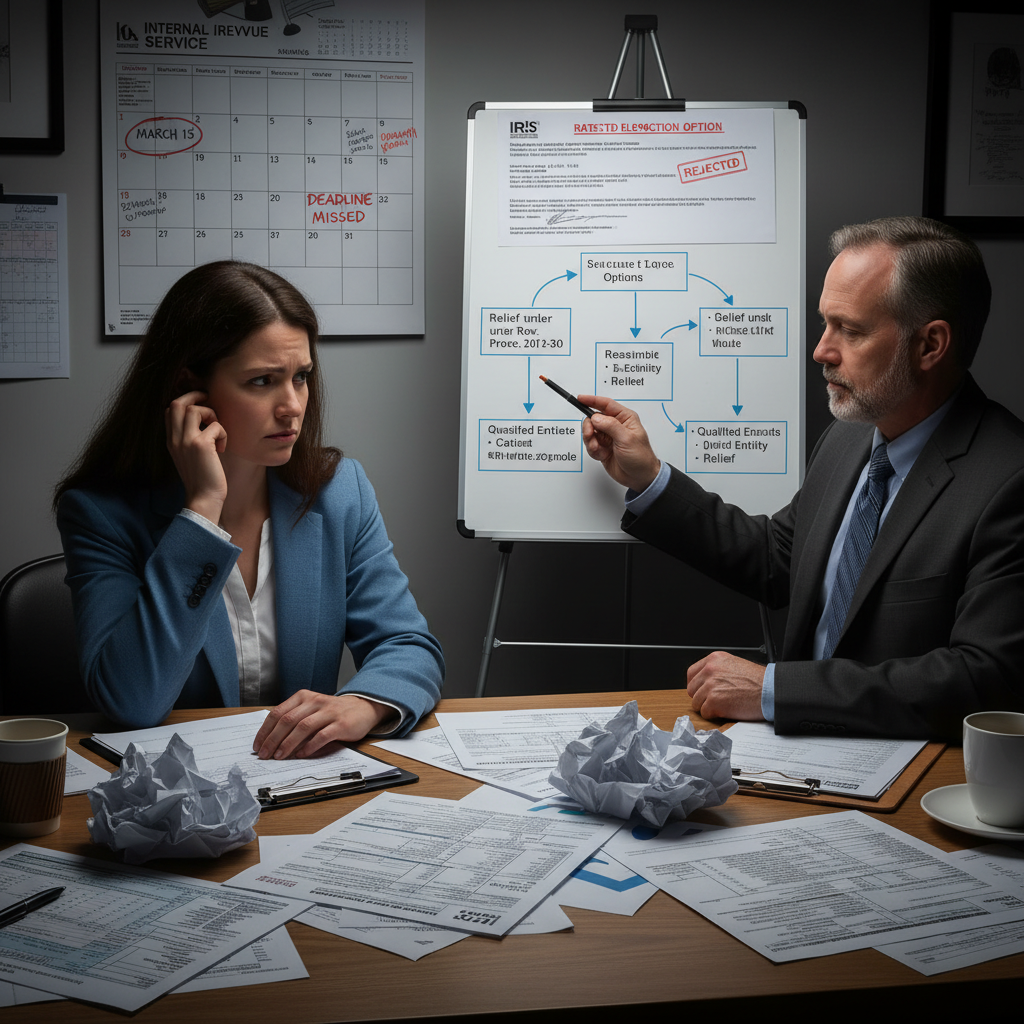

Missed the S Corp Election Deadline? The 2026 Playbook for LLCs Electing S Corp Status Late (and Legally)

Most LLC owners fear that missing the S Corp election deadline is a fatal (and costly) mistake. Here’s the reality: llc electing s corp status late isn’t just possible—it’s a strategic option if you know the IRS and California process. The difference? Getting it right can mean $10,000+ saved each year, getting it wrong means double tax and audit headaches.

Quick Answer

You can often elect S Corp status for your LLC late, using IRS relief procedures. The IRS offers an automatic late election fix—if your intent and paperwork are clear—and both federal and California recognize this path. But you must act fast, present your case convincingly, and avoid red flags with supporting documentation.

The Cost of Missing S Corp Election: Why Most LLCs Panic (and What Actually Happens)

The S Corp election deadline is March 15 of your first tax year as a corporation. Miss it, and you default to “C Corp” or partnership taxation—meaning you pay more in Social Security/Medicare (self-employment tax), risk double taxation, and lose key deduction opportunities. For an LLC with $120,000 annual profit, missing the deadline can cost $8,500+ a year in extra taxes and compliance headaches.

- Example: Julia owns a California consulting LLC. She realizes in May that her CPA never filed Form 2553. Disaster? Not exactly. With the right steps, Julia can still elect S Corp status for the year—if she has a clean story and the right records.

The IRS Late Election Fix: How “Relief for Late Election” Works

IRS offers relief under Revenue Procedure 2013-30, letting LLCs file a late S Corp election if they meet certain conditions. This means you can backdate S Corp status and claim the associated tax savings—sometimes even for prior years. Here’s how it works:

- Reasonable Cause: You must explain why you missed the deadline (e.g., bad CPA advice, misunderstanding, or oversight).

- Consistent Behavior: You’ve acted as an S Corp since your intended election date—paid owner salary, issued K-1s, etc.

- Supporting Documentation: Provide all required forms (Form 2553, income statements, evidence of payroll).

- Timely Correction: File promptly once you discover the error. The IRS is more forgiving if the late election is caught sooner.

For step-by-step instructions, see our in-depth S Corp tax guide for timelines, document templates, and implementation details.

Frequently Asked: Can You Really “Backdate” S Corp Status?

Yes—if you can prove your LLC operated like an S Corp since the intended date (reasonable salary, separate business bank account, proper documentation). The IRS prefers evidence over excuses, so clean records are your best insurance.

What Happens If You Get Denied?

The IRS will notify you via letter. You’ll revert to partnership or C Corp taxation unless you reapply. Penalties can trigger if you continue “pretending” S Corp status on tax returns without approval.

KDA Case Study: Late S Corp Election Recovery for a California Real Estate Team

Meet Ian and Melanie, co-owners of an LLC real estate group in Los Angeles. In early summer, they discovered their accountant hadn’t filed Form 2553—after they’d already run five months of payroll and K-1 allocations as if they were an S Corp. Estimated cost of missing the S Corp election deadline? $12,100 in surplus Medicare and self-employment tax for the year (with $187,000 net profit).

KDA’s team immediately gathered pay stubs, proof of owner payroll, and board minutes, then drafted a “reasonable cause” letter per Revenue Procedure 2013-30. Within 30 days, both the IRS and California Franchise Tax Board (FTB) confirmed the late election, granting S Corp status back to January 1. Ian and Melanie got refunds for interim taxes paid, and avoided a $6,000+ audit trap. Their all-in cost for the fix: $3,200. ROI for the first year? 3.8x—and they’re now fully compliant going forward.

Ready to see how we can help you? Explore more success stories on our case studies page to discover proven strategies that have saved our clients thousands in taxes.

What the IRS and California Franchise Tax Board (FTB) Really Want to See

Both the IRS and California FTB follow similar protocols, but with some state-specific rules. California requires Form 100S in addition to Form 2553, and the FTB scrutinizes payroll records more heavily. Here’s what both agencies look for when reviewing a late election request:

- Clear Intent: Emails, notes, or CPA instructions showing you intended S Corp status.

- Action Consistency: Evidence you’ve paid yourself a reasonable salary and withheld payroll taxes since intended start date.

- Chronological Clarity: Timely records—don’t try to “fix” things with a last-minute paper trail.

If you’re a business owner in California, double-check that both federal and state election steps are done. Many owners just file IRS paperwork and forget the FTB—costly mistake when state audit notices show up.

Step-by-Step: Filing a Late S Corp Election for LLCs in 2026

- Confirm Eligibility

• You’re an LLC with no more than 100 shareholders, all U.S. persons.

• Only one class of stock (most single- or multi-member LLCs are fine).

• No prior IRS or FTB S Corp revocations. - Collect Documentation

• Reasonable cause letter explaining the late filing.

• Prior tax returns, payroll registers, and internal meeting notes. - File Form 2553 with the IRS (and Form 100S with FTB)

• Complete and mail original, signed forms.

• Attach all supporting docs—the clearer, the better. - Follow Up

• The IRS is slow in 2026—expect 6–12 week turnaround (California can be even slower).

• Watch for IRS Notices and FTB letters asking for more info; reply fast and accurately.

Need expert filing? Our entity formation services handle retroactive S Corp elections, reasonable cause drafting, and cross-agency compliance.

What If You Discover the Missed Deadline in the Following Year?

If the tax year has closed, you may still be eligible for relief—but act immediately. The longer you wait, the less likely the IRS will be lenient. Provide proof that your business activities and disclosures matched S Corp treatment for the period in question.

How to Track S Corp Status (and Avoid “Missing” an Election Again)

- Place reminders in your tax calendar for every January and February.

- Confirm with your CPA (in writing) that both Form 2553 and California’s Form 100S have been filed—don’t just assume.

- Review first paychecks or K-1s by March to ensure proper tax treatment.

Common Mistakes That Cost LLCs $10K+/Year When Electing S Corp Status Late

Red Flag Alert: These errors derail most late filings (and invite IRS/FTB scrutiny):

- Not providing a “reasonable cause” statement or creating one with vague or generic explanations.

- Having owner draws instead of documented payroll/salary (must be W-2, not distributions alone).

- Missing state filings—California is especially aggressive on S Corp paperwork and penalties. Always file Form 100S and keep payroll filings bulletproof.

- Pretending to “be” an S Corp on tax returns before IRS approval—can backfire during audit and lead to double tax.

Key Takeaway: The IRS and FTB don’t want excuses. They want clean, timely, and consistent documentation. A half-baked late election almost always costs more than it saves.

FAQ: Late S Corp Election for LLCs—Your Next Questions Answered

What IRS and California forms do I need for a late S Corp election?

At a minimum: IRS Form 2553, a “reasonable cause” attachment, previous tax return proof. For California: Form 100S and matching payroll returns.

Can I fix a late S Corp election myself or do I need a professional?

If your situation is simple—one owner, proof of W-2/salary, clear records—it’s possible to DIY. If you have multiple shareholders, large profits, or messy prior filings, consult a strategist.

What’s the typical IRS (and FTB) turnaround for late election approval?

Average is 6–12 weeks (federal). California may take 12+ weeks, especially if they request more information. Don’t run S Corp payroll or issue K-1s until official confirmation arrives.

Will Late Election for S Corp Draw an Audit?

The IRS and FTB are audit-prone right now, especially for late filer S Corps. But most late elections are approved when backed by good documentation, professional filings, and proactive communication with tax authorities. If you’re worried about risk, use our premium advisory services to bulletproof every filing.

Bottom Line: Late S Corp Election Is a Fixable Mistake—If You Act with Precision

Missing the S Corp deadline isn’t the end of tax savings. For most LLC owners, it’s a wake-up call to take control of documentation, engage real expertise, and never leave entity elections to chance (or a slow CPA). Backdating is legal with the right paperwork and persistence—saving $10,000 or more per year in federal and California taxes for profitable LLCs.

This information is current as of 2/19/2026. Tax laws change frequently. Verify updates with the IRS or FTB if reading this later.

Book Your S Corp Rescue Call Now

Don’t let one missed deadline cost you $10,000 or more every year you’re in business. If you want professional handling of your S Corp election—or just need to fix a late filing for peace of mind—schedule a personalized strategy session. We’ll identify your fastest path to compliance and savings, no guesswork. Click here to book your consultation now.