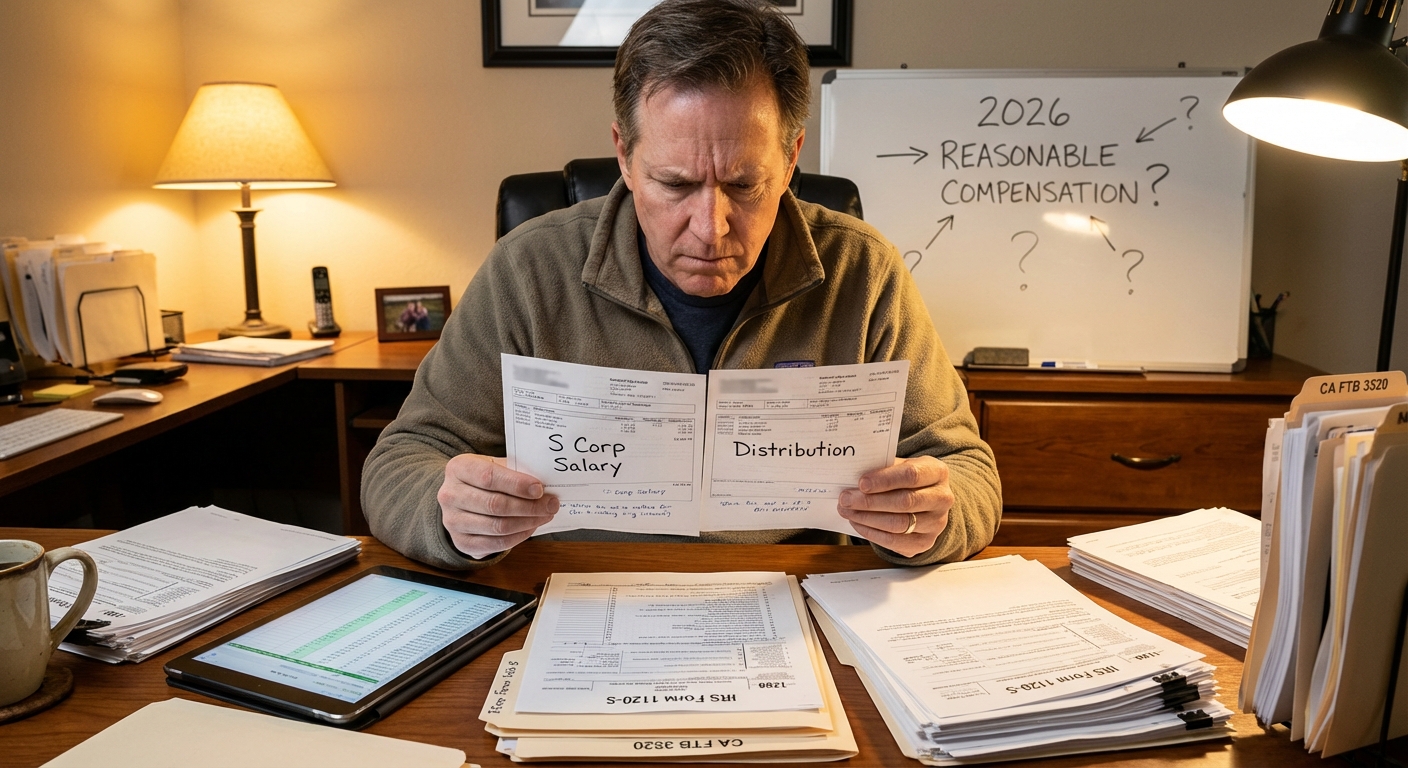

Cracking the 2026 Code: California S Corp Reasonable Salary Rules and the Audit Risks Most Owners Ignore

What is reasonable salary for S Corp California? It’s the six-figure gut check moment that stops most profitable S Corp owners in their tracks—and in 2026, it’s never been riskier to get this wrong. IRS audits are on the rise, California’s Franchise Tax Board is hunting for mismatches, and a $12,000 penalty can land with a single misstep. Most S Corp owners think paying themselves “the IRS minimum” is safe. In reality, that’s how you lose everything in a compliance sweep. Here’s what regulators actually expect, how to run your numbers, and the real tax math—including one KDA client who went from a $95,000 IRS mistake to $31,400 in clean, audit-proof salary savings.

Quick Answer: Reasonable Salary for a California S Corp in 2026

If you own a California S Corp, your “reasonable salary” must match what you’d pay someone else to do your key work, factoring in experience, industry, and region—plus tie to real pay data and evidence. The IRS and California FTB will scrutinize S Corp wages that are too low (or high) compared to distributions and peer averages. There’s no fixed number, but for 2026, this commonly ranges from $65,000–$220,000 for full-time owner-operators depending on field. The right number saves you on self-employment tax without drawing audit heat. (See IRS guidance in IRS S Corp page.)

How the IRS Defines “Reasonable Salary”—And Why California Owners Need Extra Caution

The IRS expects S Corp owners who perform services for the business to pay themselves a W-2 salary that reflects their duties, hours, qualifications, and the value of the business in the open market. This isn’t optional. Skip the W-2, or set it too low, and the IRS can reclassify ALL your S Corp payouts as wages, retroactively hitting you with payroll taxes, penalties, and interest. (See IRS Publication 535 for full details.)

California adds a second layer: the Franchise Tax Board routinely matches S Corp officer compensation to industry averages—and cracks down harder if they see S Corp owners skipping the salary requirement but still issuing shareholder distributions. This is especially true for 1099 contractors who convert to S Corp, physicians, engineers, agency owners, and real estate professionals.

If you’re a California business owner with an S Corp, or thinking of making the election, this salary rule is the single most dangerous point of failure after entity formation. Many business owners who underpay themselves don’t just lose tax savings—they end up in multi-year IRS battles with crushing back taxes and six-figure penalties.

KDA Case Study: S Corp Owner Reverses $95,000 IRS Error

Meet Chung, a Los Angeles-based design consultant and S Corp owner. Earning $210,000 in net profit, he thought $40,000 as his W-2 salary—”the minimum the IRS would accept”—was safe. In 2025, an IRS audit reclassified $120,000 in distributions as wages. He got slapped with $34,200 in back payroll taxes plus a $9,500 penalty for failure to file quarterly payroll returns. When Chung called KDA, we reviewed his job responsibilities (client management, project work, admin oversight), industry salary surveys ($88,000–$120,000 for comparable roles in his field), and the client’s education and hours worked. Our solution: Set his 2026 salary at $105,000 (well-documented, justified with surveys and signed determination files), with the rest paid as a S Corp distribution. His IRS audit was closed, penalty waived, and he kept $31,400 in annual tax savings—with future audits nearly impossible to trigger because we supplied complete “reasonable compensation” documentation.

Ready to see how we can help you? Explore more success stories on our case studies page to discover proven strategies that have saved our clients thousands in taxes.

The 5-Part Reasonable Salary Checklist: What Actually Passes Audit

- Job Duties, Time, and Value: Break out all roles (owner, sales, admin, labor, executive)—and pay yourself at least as much as you’d have to spend hiring each role separately. Use real hours (e.g., 35 billable, 10 admin per week).

- Comparable Wage Data: Pull 3+ salary reports (Bureau of Labor Statistics, Glassdoor, local recruiter data). Print and attach these for your payroll file.

- Profit vs. Salary Ratio: For most profitable S Corps, salary generally equals 45–70% of total business profit. Push this ratio below 35% and you’ll attract IRS scrutiny.

- Payroll System Compliance: Run your own W-2 through payroll—no “handwritten checks,” no end-of-year adjustments. Use formal payroll software or a trusted provider.

- Documentation: Prepare an annual Reasonable Compensation Determination File (spreadsheets, surveys, job description, time logs, signed statement). Update every year or when your role changes.

Every year, the number of S Corp audits triggered by improper compensation is climbing. A strong documentation file is your single best defense—and can save a California owner $21,000 to $78,000 in back taxes, penalties, and audit fees.

Strategic year-end moves can save thousands. Our tax planning services help identify these opportunities before December 31st.

For a complete breakdown of S Corp strategies, see our comprehensive S Corp tax guide.

Red Flag Alert: The Top Mistakes California S Corp Owners Make with Salary

- Paying $0 in Salary (Pure Distributions): Instantly triggers reclassification.

- Using the Same Salary Number for Years: Fails to adjust for role or industry changes. At audit, IRS expects ongoing market adjustments.

- Relying on Bad Benchmarks: “My buddy pays himself $30K so I can too”—every audit is unique, and peer mistakes aren’t a defense.

- Skipping Quarterly Payroll Deposits: Fines for missing deadlines now start at $780 and stack quickly.

- Not Splitting Owner Duties: If you do varied tasks, use a blended rate or tiered salary. For example, if you handle $60,000 in billable work and $20,000 in admin, document both explicitly.

Red flags are up at both IRS and FTB. In 2026, audits are increasingly informed by AI and industry data, not just random selection.

Pro Tip: How to Find—and Document—Your Ideal S Corp Salary

The best way to choose and support your salary is to use the IRS’s own checklist approach: job role, weekly hours, prior experience, certifications, geographic region, and company profit. Get at least two sources for wage data, make your own written justification, and have these files ready if ever asked. For business owners looking to run various scenarios (what happens if my salary is $70K vs $120K?), the small business tax calculator can model the impact in minutes.

FAQ: California S Corp Reasonable Salary—Real Answers for 2026

Q: If I have a loss year, do I still have to pay myself a salary?

A: If you materially participate in your business, the IRS expects a fair wage even in loss years—unless you can document you didn’t actually work, in which case zero salary may be justified. Be prepared to defend this.

Q: What if I work part-time in my S Corp?

A: Base your salary on actual hours, not a full-time peer’s pay. Document schedules and use a part-time wage benchmark.

Q: Is there a magic number that guarantees audit protection?

A: There’s never a single “safe” number, but salaries above 40% of profit, justified with outside wage data and documentation, almost always pass review.

Q: Can I pay myself irregularly or withhold taxes just at year-end?

A: Both IRS and FTB view this as a red flag. You must run regular payroll, deposit taxes quarterly, and issue Form W-2 by January 31 each year. See Form W-2 guidance.

Will This Trigger an Audit?

Owner-officers of profitable S Corps skipping salary entirely or slashing it below local industry standards face a much higher risk of audit in 2026 due to IRS data matching and CA FTB cross-checks. Implementing each step of the 5-part checklist above—and holding on to all wage/salary documentation—dramatically reduces the risk. Expect audit lookback periods of 3+ years.

Can LLCs Elect S Corp and Use the Same Rules?

Yes—if your LLC is taxed as an S Corp, you must follow the same salary requirements. Many California LLCs overlook this. See our full breakdown on the entity formation process and conversion rules for S Corps.

California-Specific: Additional S Corp Salary Landmines in 2026

- 1099 Reclassification: California is aggressively pursuing businesses labeling employees as contractors. If your S Corp pays you as a 1099, expect audits and legal risk.

- Payroll Filing Penalties: The current late fee for missing a DE-9 or payroll state return in CA is $100–$1,000 per missed form per year.

- AB5/Worker Status Shifts: If your role changes or you start hiring others, update your salary documentation immediately to reflect new responsibilities.

This information is current as of 2/8/2026. Tax laws change frequently. Verify updates with the IRS or FTB if reading this later.

3 Fast Steps to Bulletproof Your S Corp Payroll in 2026

- Set or update your salary based on job role and profit. Reference at least 2 official wage sources for justification.

- Run all payroll through trustworthy software and deposit taxes quarterly—never withhold until year-end.

- Create and save a Reasonable Compensation Determination every year—include peer data, role/time logs, and a signed summary.

Book Your Tax Strategy Session

If you’re worried your S Corp salary could cost you thousands in taxes or trigger an audit, don’t leave it to chance. Book a personalized session with our strategy team and get every detail built, justified, and compliant. Click here to book your strategy session now.