C Corp vs. S Corp: The 2025 Tax Showdown Every California Business Owner Needs to Understand

Date: September 28, 2025

Most California entrepreneurs are playing chess on a checkers board when it comes to entity choice. The phrase “I need to incorporate to save on taxes” gets whispered in almost every Bay Area café—but without understanding c corp vs. s corp realities, many end up losing five to six figures in unnecessary taxes, double taxation traps, and administrative costs. The game changes in 2025: with new federal rates, California surcharges, and tighter IRS enforcement, the wrong move can kill your after-tax profit. The good news? Structuring intelligently could be your single largest controllable wealth lever this year.

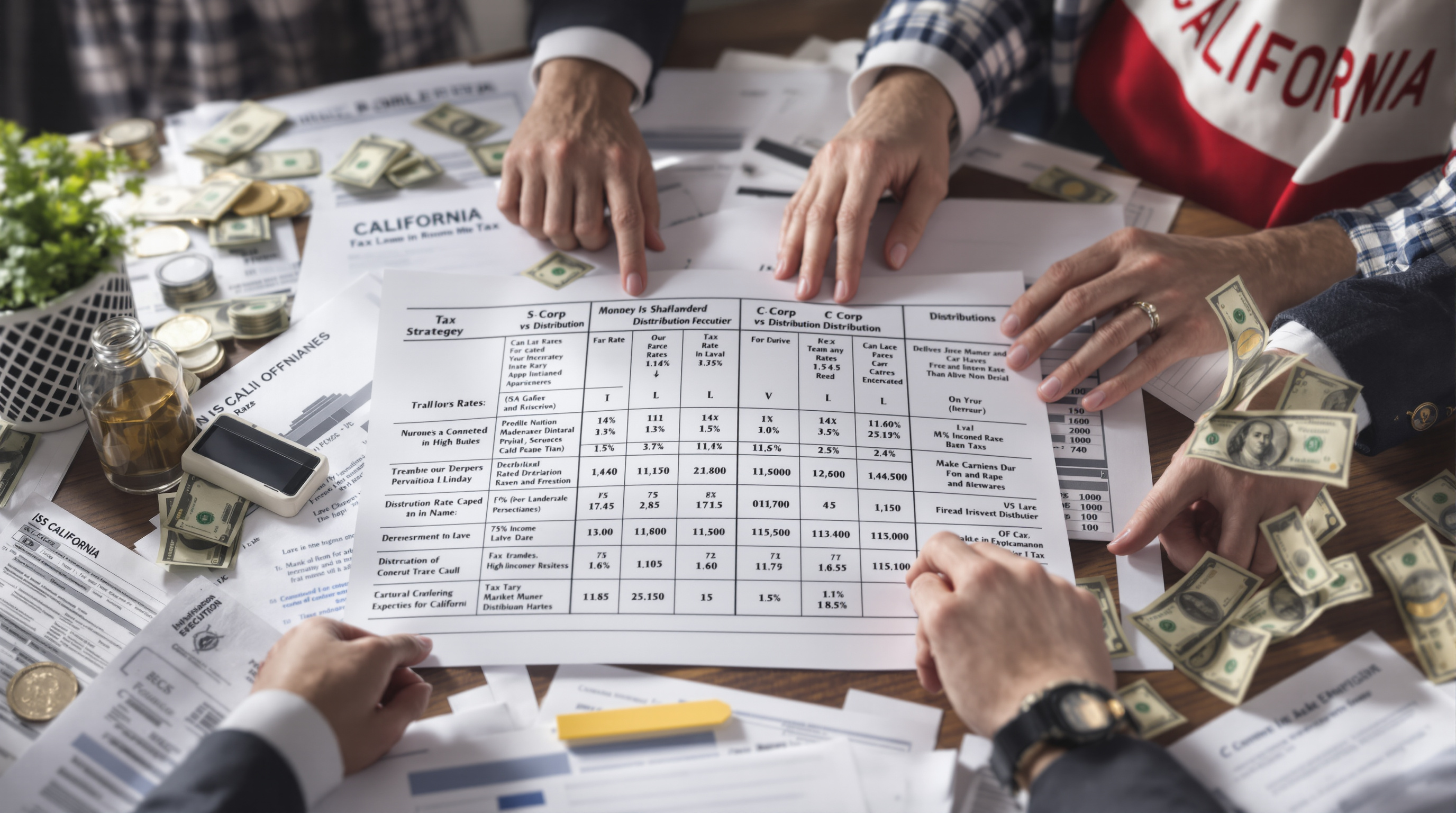

Quick Answer: C Corp vs. S Corp in 2025

Choosing between a C Corp and S Corp in California comes down to one thing: cash extraction and tax friction. C Corps face double taxation—once at the corporate level and again on dividends. S Corps avoid this, passing profits directly to shareholders, but have more rigid shareholder and salary rules. In practice, S Corps favor profitable, closely held businesses able to pay reasonable salaries and distribute excess profits. C Corps give flexibility for venture funding and stock options but are nearly always less tax-efficient for cash-cow businesses (unless you plan on a big, tax-deferred exit).

The C Corp Trap: Why Double Taxation Still Costs California Owners in 2025

Let’s get specific. C Corporations are taxed first at 21% federally (plus California’s 8.84%), so every dollar earned gets shaved by roughly 30% before you touch it. Distribute dividends? Expect a second tax hit of up to 23.8% (federal and NIIT), plus state tax on your individual return. On $500,000 in profits, a C Corp owner pulling out all cash could face $207,000+ in combined taxes—leaving under $300,000 net. By comparison, an S Corp could bring home $345,000-$385,000 after payroll and California minimum franchise tax, thanks to the single pass-through layer and savvy salary planning.

California ups the ante: its 1.5% minimum tax applies to S Corp net income, but with no “double dip” on dividends. Don’t forget the annual $800 franchise fee for both structures. The big win for C Corp? If you’re building towards a QSBS (qualified small business stock) exit under Section 1202, and qualify for up to $10M in capital gains exclusion on sale, those double taxes can be worth it. Everyone else? The math rarely works out.

How S Corps Slash Taxes Legally—And the “Reasonable Salary” Myth

S Corps exist to solve one giant pain: FICA taxes on owner profits. S Corp shareholders (usually owners) receive W-2 salaries set at “reasonable compensation” (see IRS guidance), paying employment taxes on that figure. All profits above the W-2 level? They flow through as distributions, free of Social Security/Medicare taxes but subject to federal and California income tax.

Example: Susan runs a marketing LLC with $250,000 in annual profit. As a sole proprietor, she pays SE tax (15.3%) on it all—costing $38,250 in payroll tax alone. As an S Corp, she pays herself a $100,000 salary (paying ~$15,300 FICA), and the remaining $150,000 passes through as distribution—saving over $17,250 annually. These add up, especially as profits climb.

When C Corps Win: QSBS, Stock Options, and Big Exits

C Corps aren’t just for Silicon Valley unicorns. Certain scenarios make them the best move—even for tax-savvy owners. Top reasons a C Corp may prevail in 2025:

- Raising venture capital or issuing complex stock options: Many investors require C structure

- Planning for a big company sale or IPO: Use Section 1202 QSBS exclusion to shield up to $10M in capital gains (if held 5+ years)

- Reinvesting almost all profits: If you don’t need the cash, profits stay in the corporation, enjoying a flat 21% federal rate plus 8.84% in CA

- Fringe benefits plans: C Corps can offer tax-free benefits to owners (health, dental, life, etc.) at a different scale than S Corps (see IRS Publication 15-B)

But there’s a catch: Transitioning from C to S (or vice versa) is far from smooth. Section 1374 “built-in gains tax” and California treatment of suspended losses can put you in the IRS crosshairs if you don’t plan ahead (see our complete S Corp tax strategy guide for a deep dive on traps).

KDA Case Study: S Corp Conversion Saves Consultant $37,400+ Annually

Consider David, a Bay Area tech consultant previously filing everything on a 1099 as a sole proprietor. His annual gross revenue: about $340,000, all service-based and typically issued as a handful of Form 1099-NEC every January. Until late 2024, he reported on Schedule C, paying federal and California income tax—and crucially, self-employment tax on every dollar. After analyzing his structure, KDA recommended an S Corporation conversion, helping him set a $110,000 salary with the balance as S Corp distribution. His first year S Corp payroll tax savings: $24,000. After accounting for entity setup and ongoing admin, David cleared an extra $37,400 his first year with KDA—all IRS and FTB compliant. His total investment for KDA’s restructure and year-round advisory: $5,200. Result: 7.1x ROI, better audit protection, and peace of mind.

Key Differences Between C Corp vs. S Corp: Not Just About Tax Rates

- Tax Filing Complexity: S Corps file Form 1120S and distribute K-1s; C Corps file Form 1120. C Corps need more layers of compliance, especially in California.

- Shareholder restrictions: Only U.S. individuals and certain trusts can own S Corps—no partnerships or foreign owners allowed. C Corps have no similar limit—good for VC money, not for flexible family ownership.

- Eligibility for fringe benefits: S corp shareholders owning over 2% lose tax-free access to many traditional benefits (e.g., group health), while C Corps can still deduct fully.

- Exit planning: C Corps may unlock the QSBS zero-tax exit if all rules are met.

For robust service businesses or single-owner professional shops looking to keep more what they earn, S Corps remain undefeated. C Corps shine for tech, high-growth, or asset-light firms planning for a major exit or multi-class stock issuance.

Why Most Owners Fail: The “Set It and Forget It” Pitfall with S Corps and C Corps

Too many entrepreneurs treat entity selection as a one-time box-check. In reality, IRS and FTB rules change yearly. California’s 2025 crackdown raised audit rates on S Corps suspected of unreasonably low salaries—while C Corps are seeing new enforcement around “personal service corporations.” Set your reasonable comp using accurate benchmarking data (not guesses), and revisit annually.

Red flag: Taking all profit as S Corp distributions and paying a “token” salary is a near-guaranteed IRS audit trigger. Conversely, leaving too much cash inside your C Corp risks it being labeled a “personal holding company”—triggering an additional 20% tax under IRS Section 542.

What About LLCs? Why Entity Structure Is (and Isn’t) a Silver Bullet

LLCs aren’t an entity type for tax—they’re a shell that can be taxed as disregarded entity, partnership, S Corp, or C Corp. In California, every LLC pays at least $800 plus the “gross receipts fee” as soon as revenue hits $250,000. Many owners run LLCs taxed as S Corps for the FICA benefit, but without proper payroll, documentation, and annual minutes, you risk reclassification and back taxes. Structuring your LLC as an S Corp remains the gold standard for solo service providers, agency owners, and consultants scaling beyond $120,000 in net profit.

FAQs: What Business Owners Actually Ask—No Filter

Will switching to S Corp or C Corp save me money if I already have losses?

Rarely. These structures make sense when you have consistent, predictable profits you want to extract at lower tax friction or need for external fundraising. If you’re in a startup burn phase, wait until you have clarity on future income streams. See KDA’s entity formation services for tailored guidance.

Can I convert from C Corp to S Corp (or vice versa) later?

Yes, but with tax baggage. Built-in gains tax, California loss suspension, and complex filings mean you need an expert roadmap. Never DIY a conversion—IRS and FTB mistakes can cost years of tax headaches and thousands in penalties.

What if my partner is not a U.S. person?

You can’t be an S Corp if any shareholder isn’t a qualifying U.S. person or trust. You’re likely looking at C Corp or partnership structure.

How do I pay myself in each structure?

S Corp owners must take W-2 salaries plus eligible distributions. C Corp owners earn wages if employed, and only receive dividends after board approval. Each path has IRS scrutiny in 2025, so be precise.

Why not stay a sole prop? What’s the audit risk?

Sole props are cheap to run but stick you with all self-employment tax and less legal separation. The audit risk is highest for non-incorporated businesses above $100,000 in revenue. Structuring right dramatically reduces both taxes and audit odds.

Red Flags: Fatal Mistakes That Trigger IRS and FTB Trouble

- Improper or zero payroll in S Corps—IRS penalty magnets

- Late or erroneous entity election filings (Form 2553 for S Corp, 8832 for C Corp)

- Mixing personal and business accounts in any structure

- DIY entity conversions or tax elections without expert guidance

This can be resolved with one IRS form—most taxpayers never file it right. For step-by-step, see our tax planning advisory.

Resource Corner: The Best Guide You’ll Find (With Real Examples)

For an even deeper comparison of every S Corp strategy (salary splits, payroll setup, owner draws, audit defense), check out our comprehensive S Corp tax guide. We break down real KDA client wins, IRS ruling changes, and specific documentation you’ll need for 2025 compliance in California.

Bottom Line: The “One-Size-Fits-Most” California Tax Structure in 2025

For most high-income service business owners, c corp vs. s corp is a false choice. S Corp wins for tax-efficient income extraction, pure and simple—unless you’re raising capital or planning an IPO-level exit, where C Corp may shine under Section 1202. Get a tax strategist (not a generalist) to analyze your real cash extraction goals, future liquidity events, and succession plan. Rewrite your playbook, and the numbers will speak for themselves.

Book Your California Tax Structure Strategy Session

If you’re unsure whether your current entity choice is bleeding you for $10K, $50K, or more each year—or if a looming transition (new partner, bigger profits, or capital raise) is on the table—book your tax strategy call now. We’ll deliver a custom roadmap on salary extraction, reasonable comp, and conversion options that saves you real money and audit pain. Click here to lock in your confidential entity consult today.