Automation Is the Ultimate Tax Write-Off: How Entrepreneurs Are Eliminating April 15th Panic

If you’re still dreading tax season, you’re working harder—and paying more—than you need to. Thousands of business owners waste weeks every spring chasing receipts and second-guessing their records, all while the IRS quietly penalizes the most common organizational mistakes. The real secret? Tax season stress is optional. Here’s how your peers are automating and organizing all year, turning tax time into just another quick task on their calendar—and putting more money back in their pockets for 2025.

Expert Insight: Tax automation for entrepreneurs isn’t just about using QuickBooks or apps—it’s about creating a system that mirrors how the IRS expects your records to flow. When your income, deductions, and payments sync automatically with compliant documentation, you eliminate 90% of the audit triggers that stem from manual entry errors. Done right, automation transforms tax prep into tax positioning—where your books tell the IRS exactly what you want them to see.

Quick Answer

Organizing and automating your taxes year-round creates fewer IRS problems, bigger deductions, and eliminates April stress. Start by separating your business and personal finances, automate your books with dedicated software, use mileage tracking apps, and schedule monthly check-ins. These moves turn tax planning into a powerful profit lever—no more chaos, no more missed savings.

1. Separate Your Business and Personal Finances—Or Pay for the Confusion

The simplest mistake triggering IRS audits? Mixing business and personal finances. The moment you treat your checking account as a catch-all, you create a paper trail the IRS loves to dissect—and your CPA is forced to play detective. Instead, open a dedicated business checking account and separate credit card the same week you create your business entity. This one move alone can cut hours off tax prep and provide bulletproof documentation for every deduction.

- Example: Realtor Sara set up a business bank account for her S Corp and funneled every commission and business expense through it. She avoided $2,500 in late fees and lost deductions the next spring—plus her audit risk dropped to almost zero.

- Persona Use Case: For a 1099 freelancer earning $85,000, keeping all income and legitimate expenses separate routinely means catching $7,000+ in deductions the IRS might otherwise disallow.

What If I Already Mixed My Accounts This Year?

Don’t panic. Good bookkeeping software can help you sort transactions retroactively. Make the switch now—starting with the next deposit—and document your correction for your CPA.

More on business structuring for tax clarity

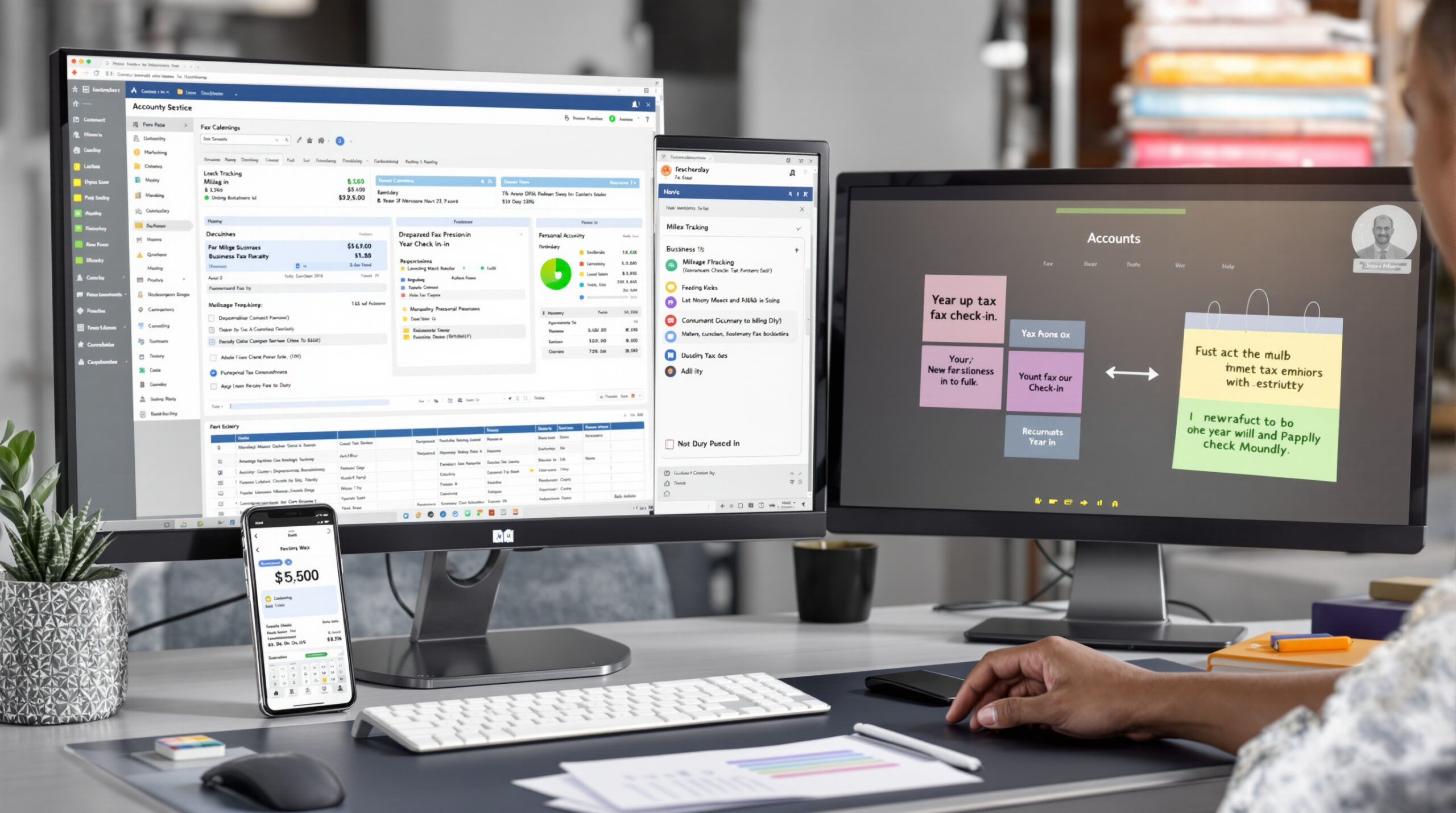

2. Automate Your Bookkeeping: Your Tax Organizer That Never Sleeps

Dragging a shoebox of receipts to your accountant is not a badge of honor. There are more ways to automate your records in 2025 than ever. The best: cloud-based bookkeeping platforms like QuickBooks Online, Xero, or Wave. Link your bank and credit card accounts directly, and enable rules to automatically sort expenses: meals, travel, supplies, and more. These apps let you capture receipts with your phone—no more faded slips or lost backup for an IRS exam.

From a strategist’s perspective, tax automation for entrepreneurs is a cash flow system disguised as compliance. When your income and expenses sync daily, you can forecast quarterly tax payments accurately and avoid both underpayment penalties (up to 25% per IRS §6654) and overpayment “loans” to the government. This is how top-earning business owners turn tax software into a financial control center—not just an expense tracker.

- Example: Construction company owner Mike uses QuickBooks to snap photos of every supply run. When the IRS requested proof during a random audit, he produced two years of digital records in minutes—saving $18,000 in disallowed expenses.

- Implementation: Set up automated bank imports and expense categories. Review uncategorized transactions monthly for full capture. Use software receipt logging for IRS-compliant records—many apps export directly in audit-ready format.

Is Software Worth the Monthly Fee?

For most small businesses, bookkeeping apps cost $20–$40/month. Compare that to the hundreds (or thousands) in missed deductions and late-filing penalties. For a freelancer, one missed $600 expense could swallow an entire year’s software fee.

See our custom bookkeeping system for entrepreneurs

3. Track Your Mileage Automatically—Stop Leaving $4,000+ on the Table

Vehicle deductions are among the IRS’s most scrutinized write-offs. Yet, almost every business owner fails to log mileage accurately, forfeiting an average of $3,500–$6,000 per year according to IRS studies. Mileage tracking apps (like MileIQ or Everlance) run in the background, automatically detecting business trips, and let you swipe to classify them as business or personal. The result: ironclad deduction support—no post-it notes, no end-of-year guesswork.

- Example: Consultant Rachel drove 8,000 business miles last year. By using Everlance, she accurately documented the drives, securing nearly $4,500 in 2024 write-offs that would have been thrown out in an audit due to lack of hard proof.

- Pro Tip: The 2025 standard mileage rate is 67 cents/mile—track every eligible trip! (Review the latest IRS mileage rates)

What the IRS Won’t Tell You About Mileage Audits

Handwritten logs almost always get rejected if they’re not updated contemporaneously. Automated apps make your deductions stick without the audit risk.

Deep dive: Business vehicle deductions and compliance

4. Schedule Monthly and Quarterly Tax Check-Ins—Never Get Surprised Again

Tax season isn’t an April problem—it’s a monthly system. Set 60-minute blocks every month to review your books, scan for missing deductions, and flag large expenses. Do a deeper review at quarter’s end: estimate taxes (pay via IRS Direct Pay), review quarterly profit/loss, and adjust withholding or strategy with your accountant. This approach protects your cash flow and eliminates last-minute surprises—especially for business owners subject to estimated tax payments and growing profit.

Smart tax automation for entrepreneurs goes beyond bookkeeping—it helps forecast and fund quarterly tax payments with precision. Syncing your accounting software with a tax estimator ensures each quarter’s payments align with your real-time profit data, not outdated projections. This prevents underpayment penalties and smooths cash flow, especially for S Corp owners juggling payroll tax deposits and estimated self-employment liabilities.

- Example: Karl, a small business owner, blocked off the last Friday of each month as “CEO tax time” on his calendar. He moved from annual panic to finishing his 2024 returns three months early—with an extra $8,200 in credits and deductions identified during those sessions.

- Implementation: Use your calendar app to schedule recurring meetings. Tie your bookkeeping app review, tax payment reminders, and scan of potential big write-offs into one checklist.

Can an Outsourced Bookkeeper Do This For Me?

Yes, if they have your books fully automated and share monthly reports. But most business owners should review their data at least monthly—or risk missing high-impact moves that can’t be fixed after December 31.

Tax automation and advisory: See all services

Why Most Business Owners Turn Tax Prep Into an Annual Nightmare

There’s a reason most entrepreneurs loathe tax season: they treat it as a one-and-done event, not a system. The real cost shows up as missed deductions, accidental IRS red flags, and emergency document hunts. In 2023, the IRS penalized small businesses over $2.4 billion for late or inaccurate filings. Routine, automated tax management is the only answer.

Think of tax automation for entrepreneurs as the backbone of proactive tax strategy. Every automated process—bank feeds, categorized expenses, mileage tracking—creates the audit-ready data your CPA needs to recommend real strategies: Section 179 expensing, accountable plan reimbursements, or S Corp payroll optimization. The result is fewer surprises, stronger documentation, and the ability to plan your taxes like a CFO instead of reacting like a taxpayer.

💡 Pro Tip: The IRS wants consistency. Year-round organization keeps your business off their radar and powers up your write-offs.

FAQ: Everything a Modern Business Owner Asks About Tax Automation

How do I choose the best bookkeeping app?

Look for software that integrates directly with your bank, allows mobile imaging of receipts, and lets you export audit-ready reports. Top picks include QuickBooks Online for comprehensive features and Wave for leaner, free options.

What if my business is cash-based?

Digital systems matter even more for cash-based businesses. Use an app to record deposits immediately and capture cash expenses with receipt imaging. If audited, this is how you prove your deductions and income.

Does this work for both sole proprietors and S Corps?

Absolutely. The principles are the same—just adapt your system to your entity’s tax requirements (like tracking S Corp payroll or deducting owner healthcare premiums).

Ready to Make Tax Stress Optional?

You don’t have to chase deductions or suffer through IRS surprises. The strategies above are low-cost, high-impact moves that make tax management nearly automatic. For 2025, invest three hours now to automate your taxes—and claim the returns for years ahead.

Book Your Custom Tax Automation Blueprint

Is your system costing you time, money, or IRS peace of mind? Book a strategy session with our experts, and walk away with a tailored automation game plan and three deductions most business owners miss. Click here to book your session now.