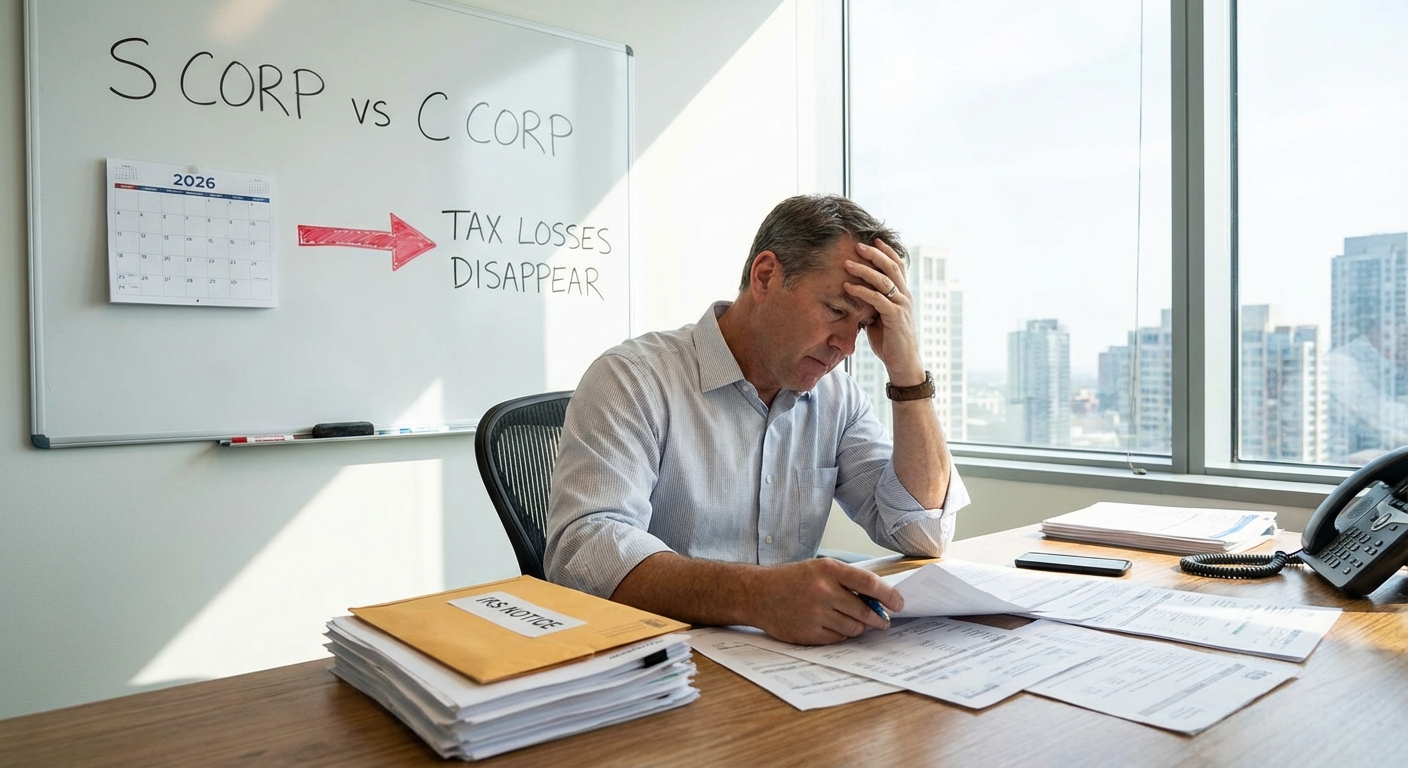

The Unseen Consequence: S Corp Losses Lost When You Convert to C Corp in 2026

If you own a business structured as an S Corporation and are thinking about converting to a C Corporation in 2026, there’s one move that could cost you tens of thousands, and nearly no CPA is talking about it. S Corp losses lost when you convert to C Corp. For high-income entrepreneurs and investors who plan to leverage those tax losses—or even carry them into future years—2026 is a line in the sand. Ignore this, and your next tax bill could be far higher than you ever anticipated.

When owners underestimate how s corp losses lost when convert to c corp actually works, they usually assume losses “follow the business.” They don’t. Under IRC §1366(d) and IRS Publication 542, suspended S Corp losses are shareholder-level attributes that terminate the moment S status ends. Conversion doesn’t defer them, transfer them, or preserve them—it extinguishes them.

Quick Answer

If you switch from S Corp to C Corp, any unused S Corp losses—also known as suspended losses—vanish at conversion. You can’t use these losses against future C Corp income or carry them forward personally. For 2026, new federal restrictions mean you may only deduct up to 90% of S Corp losses in the conversion year, and California may follow suit. The rest becomes a phantom deduction—you never get the money back.

How S Corp Losses Actually Work (and Where They Go)

Let’s spell it out: S Corps allow income, deductions, and losses to “pass through” to the owner’s personal return—usually on Schedule E of Form 1040. But there’s a catch: If your losses exceed your basis (i.e., what you’ve invested plus previous profits minus withdrawals), you can’t take those losses now. They’re called “suspended losses.” They hang around—on your personal tax records—until you either have enough basis or dispose of your ownership (by sale, liquidation, or sometimes, conversion). For business owners, this pass-through structure is an asset during unprofitable early years or volatile income periods.

The reason s corp losses lost when convert to c corp catches founders off guard is that the IRS treats conversion as a clean break, not a continuation. Once the entity becomes a C Corp, there is no Schedule E reporting, no shareholder basis tracking, and no legal mechanism to reattach prior S Corp losses. Even if ownership stays identical, the tax identity resets—and suspended losses die with the S Corp election.

But as of 2026, thanks to updates like the One Big Beautiful Bill Act (OBBBA), only 90% of current and carryforward S Corp losses are deductible in the conversion year (source: Forbes: 2026 IRS Updates). And when you switch to a C Corp, nothing carries over. S Corp losses die at the border.

There’s no IRS grace period. No special form to file. No way to retroactively recoup these losses as a C Corp in later years. This rule traps businesses with big growth swings—tech, consulting, and real estate firms most of all.

KDA Case Study: Tech Startup Owner Loses $57,000 in S Corp Losses on C Corp Flip

In 2025, “Jerome,” a SaaS founder, had $320,000 of suspended S Corp losses after years of heavy investment and uneven cash flow. His CPA advised him to convert to a C Corp in 2026 to attract VC funding—without warning him that the S Corp losses would vanish. KDA reviewed his returns and discovered the oversight just before the conversion paperwork was filed. Our team restructured the transition by injecting additional basis (using a shareholder loan and a timing play) so Jerome could unlock $41,700 in losses on his 2025 return. Because $15,300 still remained, we front-loaded S Corp income in early 2026, matched it against the losses, and saved $14,700 in taxes that would have been lost if he’d gone through with the conversion cold. KDA invoiced $4,200—Jerome secured $56,400 in real write-offs that would have otherwise evaporated.

Ready to see how we can help you? Explore more success stories on our case studies page to discover proven strategies that have saved our clients thousands in taxes.

The IRS Trap: When S Corp Losses Vanish (and How to Rescue Them)

If you’ve built up S Corp losses—due to startup costs, aggressive investments, or multiple years of red-ink—you have one shot to use them: before you abandon S Corp status. The IRS will block suspended losses from crossing into your new C Corp entity. Instead, the ability to use these losses ends immediately at the moment of conversion (per IRS Publication 542).

Bottom line: If you don’t restore enough basis or generate enough S Corp income pre-conversion to absorb suspended losses, they disappear permanently. You can’t amend a C Corp return to claim them. Your C Corp can’t deduct past S Corp losses against future corporate earnings, and your personal tax return loses those carryforwards for good.

If you’re facing this scenario, time is running out. Strategic plays (like basis restoration, S Corp bonus income accelerations, or even partial distributions) can sometimes “unlock” these losses the year before conversion. Our tax planning services specialize in this high-stakes rescue—especially for seven-figure founders, consultants, and advanced real estate groups.

Common Mistake That Triggers an IRS Audit: Misreporting S Corp Losses at Conversion

Audit red flag: Calculating your S Corp losses incorrectly or attempting to “move” suspended losses into C Corp years is one of the top causes for audit and penalty assessments in the 2026 transition. Do NOT try to sneak these deductions onto your new entity’s books. The IRS is aggressively tracking conversions and unclaimed loss carryforwards—especially in high-earner and California markets. Reference IRS Publication 542 for conversion rules, but the core truth is simple: Losses not used pre-conversion are lost forever.

Pro Tip: If you’re planning a conversion to C Corp, request a shareholder basis analysis from your CPA to see if any quick moves can “untrap” these losses. Waiting until after the conversion is too late.

California’s 2026 Twist: Will the State Also Wipe Out Your Losses?

While California has typically piggybacked on federal S Corp rules for suspended losses, the looming fiscal crunch means the Franchise Tax Board is looking at adopting similar or even stricter treatment post-2026. If the state legislature passes alignment with OBBBA, CA business owners could lose both federal and state write-offs overnight if they convert S Corp to C Corp after the threshold date.

This makes it doubly important to run the tax math and consider state-level consequences. Timing the transaction and maximizing use of all available losses before the state rule change is non-negotiable—for both compliance and cash flow risk. For more detail on advanced S Corp strategy, see our complete S Corp tax guide.

What If I Have Both S Corp and C Corp Entities?

Some business owners run parallel entities (e.g., a consulting S Corp and a real estate C Corp). If you convert one, you cannot offset S Corp losses from the other with any new C Corp income. Each entity’s tax treatment—and its suspended losses—are “ring-fenced” to their own lifespans. Strategic entity structuring is critical to keep deductions alive in transition years. For custom entity guidance, review our entity formation services.

Will This Trigger an IRS Audit?

While entity conversions are not automatically audited, any owner attempting to “reuse” S Corp losses, misreport stock basis, or claim losses post-conversion draws heavy IRS scrutiny—especially with large dollar values or inconsistent reporting. For the 2026 tax year, audit risk is heightened due to increased IRS oversight of S Corp and C Corp transitions and the agency’s new central reporting CEO structure.

Step-by-Step: How to Capture Your S Corp Losses Before Converting

- Calculate Suspended Losses: Have your tax advisor pull your S Corp basis statements and suspended loss schedules as of year-end.

- Restore Basis if Needed: Consider shareholder loans or capital contributions to increase basis, making more losses immediately usable.

- Generate S Corp Income: If practical, accelerate income, delay deductions, or execute client billings to “use up” losses before conversion.

- Offset with Distributions: Take strategic distributions (if allowable) to clear out any remaining losses—but watch dividend traps.

- Convert: Only initiate the S to C conversion after verifying no losses remain on the books.

Key Takeaway: Any S Corp loss not used before conversion is lost forever—with no ability to recover after C Corp election.

Myth-Busting: Can’t I Just Carry Over S Corp Losses Personally?

No. Some business owners believe their unutilized S Corp losses are “banks” they can access later even after the business changes form. This belief is false. Suspended S Corp losses are only available to offset S Corp income—and only while you are a shareholder of an S Corp. C Corp shareholders, even if they’re the same individuals, do not get a personal or entity benefit from their prior S Corp losses post-conversion.

Red Flag Alert: Any attempt to shift or double-deduct these amounts is considered tax evasion by IRS standards.

Frequently Asked Questions: S Corp Losses Going Up in Smoke

Do S Corp Losses Carry Over When I Convert to C Corp?

No. You lose them unless you use them in the final S Corp year.

Is There Any Exception for Suspended S Corp Losses?

If you sell your shares instead of converting the entity, special rules may apply, but you still cannot “migrate” those losses to new C Corp income. Consult IRS Publication 542 for nuances.

How Much Can I Deduct in 2026 Under the New Rule?

Only 90% of available S Corp losses in the year of conversion, based on current IRS guidance and OBBBA.

What Happens to Losses Not Used?

They disappear. You can’t use them later, even if the C Corp later becomes an S Corp again.

If I Have Multiple Owners, Do We Each Lose Our Share?

Yes. The loss is tracked at the shareholder level and is unrecoverable after conversion for everyone, pro rata.

Pro Tip & Mic Drop

Pro Tip: Do not ignore suspended S Corp losses before a C Corp conversion—accelerate S Corp income, restore basis, or risk a permanent loss.

Mic Drop: The IRS isn’t hiding these conversion rules—most accountants just rely on software instead of actual strategy.

Book Your Entity & Loss Rescue Strategy Session

S Corp losses at risk? Don’t let your hard-earned write-offs go up in smoke. Book a personalized, high-stakes entity transition session with the KDA strategy team—you’ll get a custom, actionable plan to capture every last dollar and avoid permanent loss. Click here to book your consultation now.