Do I Have a C Corp or S Corp? How to Tell, Why It Matters, and the Savings (or Traps) Most Owners Miss in 2026

Every year, hundreds of thousands of California business owners stare at their “Inc.” or “LLC” paperwork and genuinely don’t know: Do I have a C Corp or S Corp? The answer determines how your profits are taxed, the forms you file, what happens if you sell, and even if you’ll be hit with double taxation. The cost of guessing wrong in 2026? For an owner making $150,000, getting this wrong can mean losing $12,000–$45,000 that could have been legally yours.

Quick Answer: How to Tell the Difference Between C Corp and S Corp

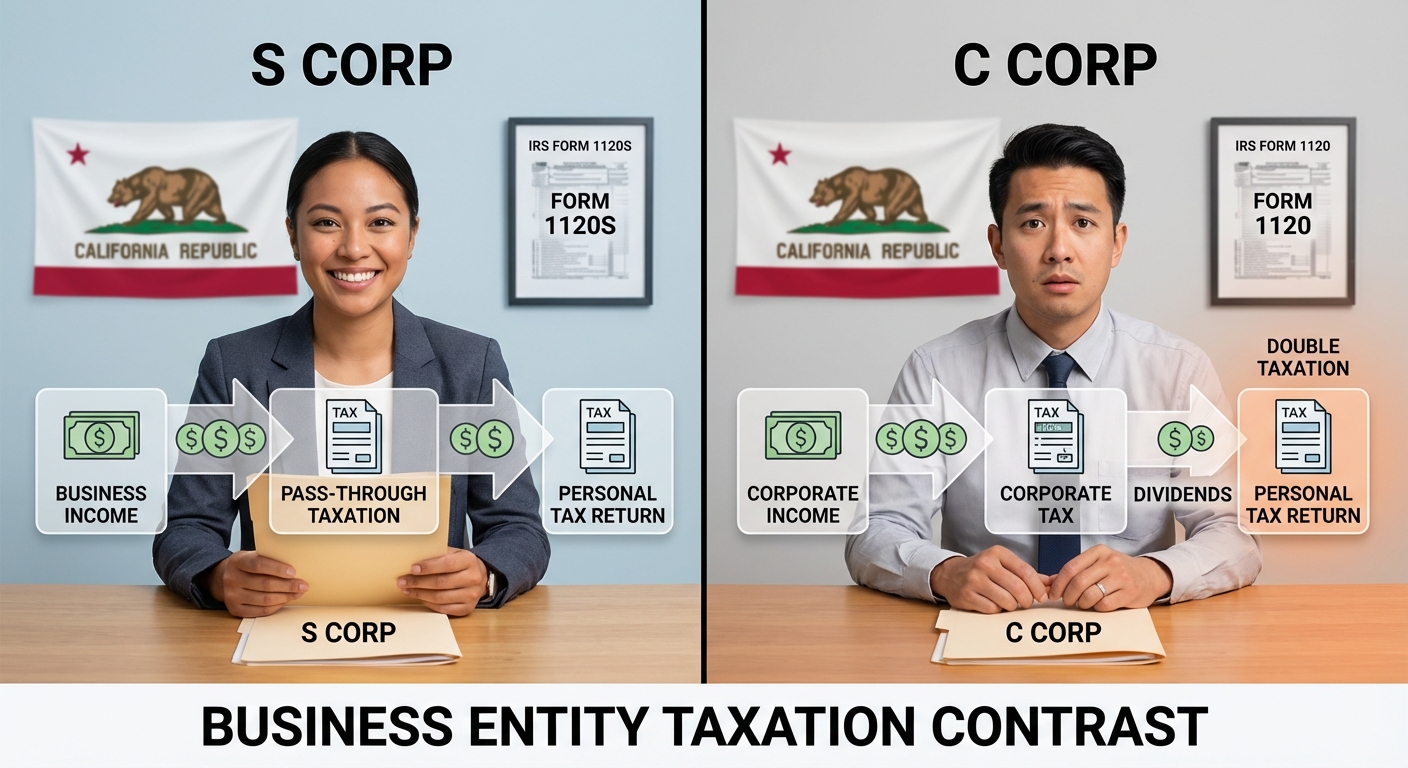

The easiest way to tell is on your IRS tax forms: If your business files Form 1120, it’s a C Corporation (subject to double taxation). If it files Form 1120S, it’s an S Corporation (income flows through to your personal return, skipping the corporate tax level). But entity status isn’t just about paperwork. It’s the result of a conscious election (an S Corp must file IRS Form 2553). If you haven’t filed this, or you’re not sure, assume you’re a C Corp until proven otherwise. For the 2026 tax season, the distinction changes not just taxes but compliance workload and potential audit risk.

Why Entity Classification Isn’t Just a Technicality: The High-Dollar Impact

Business structures get thrown around as buzzwords, but the wrong classification is a multi-dollar mistake. Here’s how the numbers break down in practical terms for 2026:

- C Corp: Profits are taxed at the flat corporate tax rate (21% federal), then taxed again when distributed as dividends to shareholders. Example: $200,000 profit taxed at 21% ($42,000), then distributed $158,000 taxed on your personal return (potentially 15-23.8%). Effective combined tax can hit 39% or higher with state and local.

- S Corp: Profits aren’t taxed at the company level. Instead, they “pass through” to your personal 1040, typically saving 10–15% over a C Corp for the same income, with payroll taxes only on your reasonable W-2 salary.

For a $120,000/year solo consultant, fixing a misclassification from C to S Corp can mean $12,400 in direct tax savings—even before state-level adjustments and deduction differences. That’s money that funds your next business investment, not Uncle Sam’s budget.

Who Should Check Their Status: W-2, 1099, Real Estate, and LLC Owners

If you are receiving 1099 payments, running a service business with more than $75K in profit, or own rental real estate inside an entity, knowing whether you’re classified as business owners with S Corp or C Corp status is non-negotiable. California’s Franchise Tax Board (FTB) treats C Corps and S Corps differently, especially when it comes to the $800 minimum franchise tax, gross receipts fees, and the new penalties under updated California law for late or incorrect S Corp elections.

This information is current as of 2/1/2026. Tax laws change frequently. Verify updates with the IRS or FTB if reading this later.

How to Officially Check: IRS Forms, California SOS, and Entity Documents

Official verification means digging into three places:

- IRS Acceptance Letter: If you have an S Corp, you received a letter from the IRS confirming approval of your Form 2553 (usually Letter CP261). No letter? You may be a C Corp by default.

- Annual Tax Returns: Look for IRS Form 1120S (S Corp) or Form 1120 (C Corp) from your prior year filings. If you use a preparer, request a copy.

- California Secretary of State Website: Search your business name. S Corp status won’t always display, but you can confirm if your entity is listed as a corporation.

If you’re new to this, download your recent tax returns or ask your CPA specifically: “Which form did we file for the company last year?”

Pro Tip:

If you are seeing K-1 forms and your business is owned by multiple unrelated parties, ensure you’re not being taxed as a partnership—this distinction changes your deduction opportunities.

KDA Case Study: Real Estate Team Gets $41K Back After Fixing Classification

Let’s look at an actual KDA client: A real estate group with $320,000 in net profit believed they were an S Corp after filing California incorporation paperwork, but never filed IRS Form 2553. For two years, they paid corporate tax rates, then distributed after-tax profit as dividends—resulting in double taxation. After KDA’s review, we identified the misclassification, filed a late S Corp election (including a detailed Statement of Reasonable Cause), and retroactively converted their prior two years with IRS and FTB support. The team recovered $41,050 in overpaid federal and state taxes with our help, paid $5,900 in back-tax preparation fees, and netted an ROI of over 7x in the first year alone.

Ready to see how we can help you? Explore more success stories on our case studies page to discover proven strategies that have saved our clients thousands in taxes.

What the IRS and FTB Won’t Tell You About S Corp vs. C Corp Status in California

Here’s the dirty secret: Many owners are stuck as a C Corp, not because they chose it, but because no one ever filed the paperwork to elect S Corp status. The IRS and California FTB do not automatically convert your company—even if your CPA talks about “pass-through” benefits. In 2026, this technicality is more expensive than ever:

- New Law in 2025: Late or missed S Corp elections can now trigger additional state penalties unless you proactively file FTB Form 3560 (Statement of Reasonable Cause) with supporting documentation.

- Unfiled S Corp Election = C Corp by default, regardless of ownership or business purpose.

- Payroll Tax Penalties: S Corps must pay reasonable W-2 wages; C Corps are at higher risk for misclassifying dividends as wages (subject to back FICA taxes).

Miss this step and the IRS or FTB won’t warn you—they’ll just assess the higher tax after the year closes. For a deep dive on S Corp rules, see our comprehensive S Corp tax guide.

How to Change Your Entity Status—Step by Step for 2026

- Check Your Tax Return from Last Year: Was it a Form 1120 (C Corp) or 1120S (S Corp)?

- Find Your IRS Acceptance Letter: Search for Form 2553 approval—without this letter, you’re not legally recognized as an S Corp.

- If You Need S Corp Status:

- Download IRS Form 2553. Complete ALL required fields.

- Submit before March 15th, 2026 to have status effective for tax year 2026 (late elections may be possible, but have added requirements in 2026).

- Attach a Reasonable Cause statement if late—California now requires parallel notice to the FTB.

- Consult a professional entity formation service or experienced CPA for strategy—incorrect filings can invalidate your election.

Key Takeaway: You cannot “accidentally” become an S Corp. You must file IRS Form 2553 and receive confirmation. If in doubt, check last year’s federal return and acceptance letter—if missing, you are a C Corp.

Common Owner Mistakes: Where DIY and “Default” Cost Big

Here’s what we see with DIY filers and unspecialized bookkeepers in 2026:

- Assuming State Filing Changes IRS Status: Incorporating with the California Secretary of State does not create an S Corp; only IRS acceptance does.

- Missing Payroll for S Corps: S Corps require “reasonable compensation” on payroll before taking owner draws. Neglecting this can trigger IRS audits and penalties. For details, see IRS Publication 535 on business expenses.

- Paying Double Franchise Tax: C Corps in California may owe a 1.5% minimum franchise tax on net income, while S Corps pay the $800 minimum plus a separate 1.5% on net income (but avoid the federal double tax penalty).

Fix: Always verify with your CPA. Have them document your status, payroll history, and IRS communications in your permanent records. The IRS will not proactively correct classification errors—even honest mistakes.

What If You’re an LLC? Understanding S Corp Election and C Corp Default

LLC owners have flexibility, but they must likewise make an election to be taxed as S Corp (by filing Form 2553) or C Corp (by filing Form 8832). Without one, LLCs are taxed as sole proprietors (single member) or partnerships (multi-member) by default. Making the right election allows you to save thousands in payroll tax or avoid costly double taxation on large distributions. For tailored advice, our premium advisory services break down the best fit based on your actual income and owner composition.

FAQ: Quick Answers to Common “Do I Have a C Corp or S Corp?” Questions

- Can I “retroactively” fix my entity classification mistake? Sometimes, yes. The IRS allows late S Corp elections with reasonable cause, but the process is stricter in 2026—paperwork must be complete, with detailed timelines and signatures from all owners.

- Who should NOT be an S Corp? Businesses with many types of non-individual owners, foreign owners, or those anticipating large retained earnings (not distributed) may benefit from C Corp status.

- Can I change from C Corp to S Corp in the middle of the year? With limitations. Generally, S Corp status must be elected by March 15th to take effect that tax year; outside of window, you wait until next tax year unless you qualify for relief.

- If I don’t know what entity I am, can KDA diagnose and fix it? Absolutely—this is what we do every week for California entrepreneurs, medical practices, tech companies, and real estate investors.

Red Flag Alert: The IRS and Franchise Tax Board Are Cracking Down in 2026

The IRS’s increased compliance efforts, combined with California’s strict penalty enforcement, mean 2026 is not the year to guess at your entity classification. If the IRS suspects unpaid payroll taxes or receives a mismatched K-1 or W-2, you’ll receive a CP2000 notice or worse—an audit or penalty. From our experience, sorting out your real status and correcting mistakes early in the year prevents five-figure penalties and endless paperwork nightmares.

Book Your Entity Status Review with KDA

If you don’t know whether you’re a C Corp or S Corp—or are worried you’ve been filing incorrectly—it’s time for an expert review. Our team identifies misclassifications, corrects IRS filings, and gets you out of double-taxation or penalty traps. Book your custom entity status review today and keep more of your hard-earned profits.