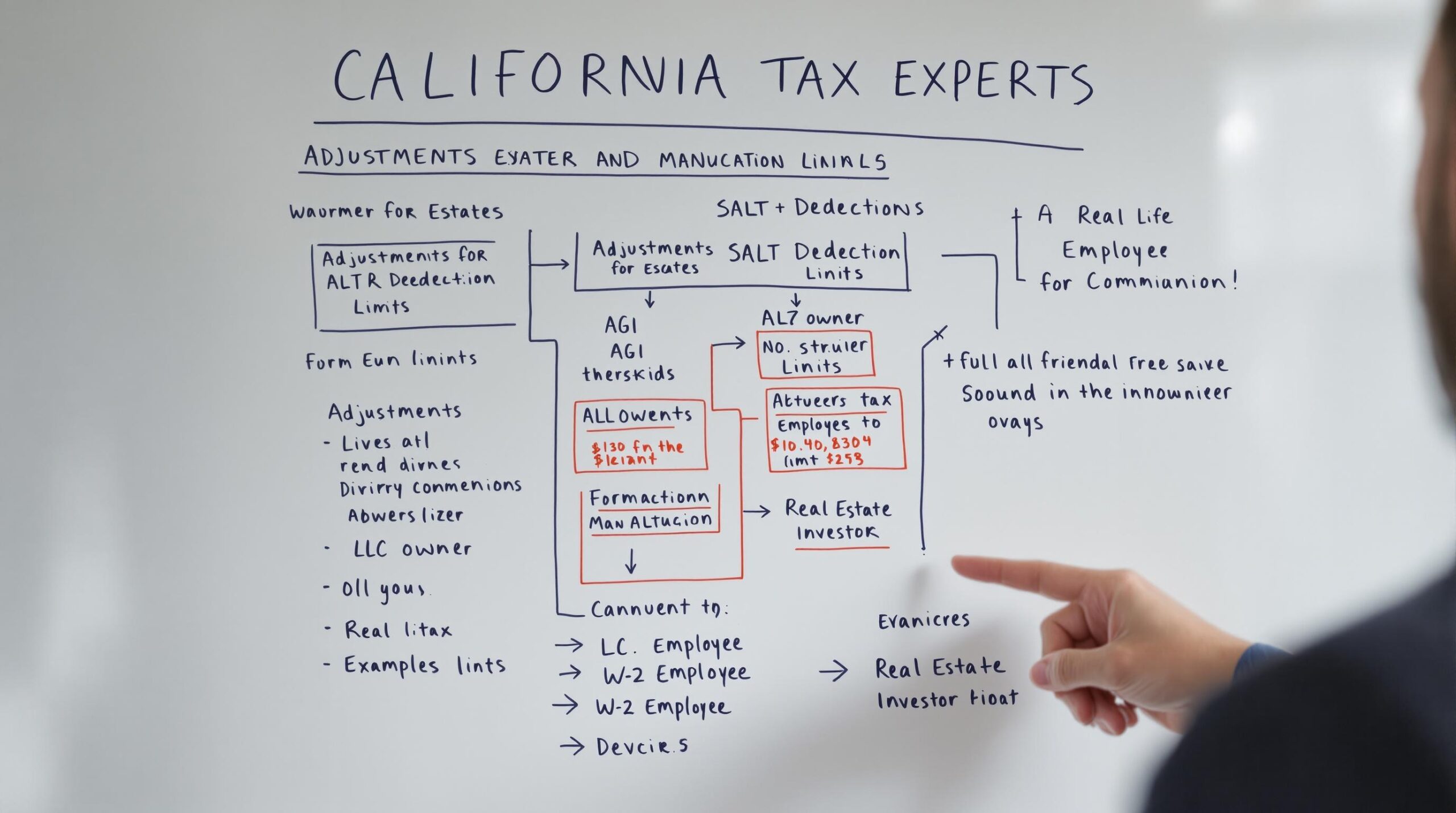

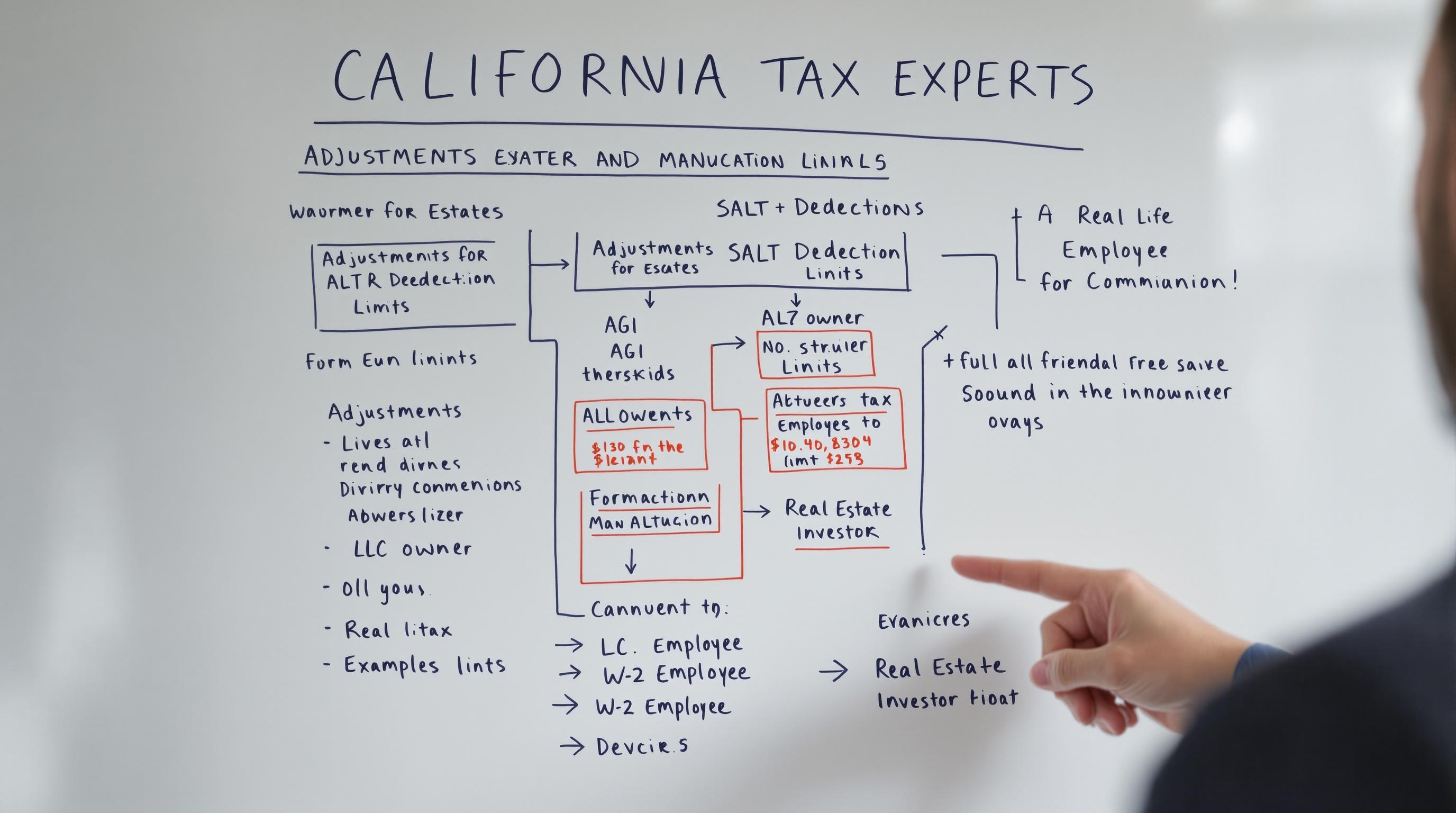

2025 California SALT Deduction, Estate Limits, and AGI Cliffs: How Real Taxpayers Will Win (or Lose) Under the New Rules

California taxpayers are on the edge of major tax law shifts, but most don’t realize this year’s changes are designed to quietly shift the tax burden onto the unsuspecting. High-earning business owners, W-2 employees, and real estate investors who assume last year’s strategies will work are headed for ugly surprises at filing time. But the few who adjust now will lock in five-figure savings others will never see.

This is not the year to ignore the fine print: For 2025, the California SALT deduction cap increases to $40,000 — but ONLY for those with AGIs under $500,000. Meanwhile, estate and gift exemptions tick upward, but the IRS introduces new Pease limitations that hit trusts and estates hard. Here’s what real taxpayers need to do—fast—to protect their after-tax wealth under the new order.

Quick Answer: What Changed — And Who’s Affected?

For 2025, California’s new tax laws include a much higher SALT deduction cap, higher estate/gift exemptions, and tougher AGI cliffs that wipe out deductions for high earners. The rules favor those who plan entity structure, accelerate deductions, and act before year-end. If you’re a business owner, high-earning W-2, or real estate investor, you need a custom plan now—especially if your AGI is near a cliff.

Section 1: The $40,000 SALT Deduction Cap — The Devil in the Details

For years, the $10,000 federal cap on state and local tax (SALT) deductions stung high-earning Californians, especially those with property taxes and high income. Now, the One Big Beautiful Bill Act (OBBBA) raises this cap to $40,000—sounds like a windfall. But here’s the catch: Only those with adjusted gross incomes (AGI) under $500,000 get the full increase.

Example: A dual-income couple in the Bay Area, both earning $200K, with $18,000 in property taxes and $25,000 in state income taxes, previously maxed out at $10K SALT deduction. If their AGI stays under $500K, they can now deduct the full $43,000—resulting in a federal tax reduction of roughly $9,900 (assuming a 24% marginal rate).

But a business owner whose AGI exceeds $500K is locked out of this break entirely—no increase, no partial deduction. And AGI is calculated before many deductions, so even deferred retirement or HSA contributions may not help once you’re over the cliff.

The California SALT deduction isn’t just about writing off property taxes anymore—it’s about managing your AGI like a scalpel. The IRS calculates AGI before key deductions like 401(k) contributions or HSAs, meaning a taxpayer at $510K AGI could lose $33,000 of write-offs instantly. If you’re within striking distance of $500K, the most effective play is timing: defer income or accelerate deductions so the IRS recognizes you below the cliff.

The New Trap: SALT Cap Phase-Out for High Earners

- Crossing the $500K AGI threshold eliminates the extra SALT deduction instantly—no phase-in.

- Trusts and estates face similar, but even lower thresholds, due to the compressed tax bracket structure.

Strategists treating the California SALT deduction as a free $40,000 write-off will get burned. The IRS limit applies per return, not per spouse, and trusts face compressed brackets where the benefit can disappear at just $14,451 of taxable income. That means if you have income split across multiple K-1s or trusts, you must model each entity separately to avoid a silent phase-out

Bottom line: If your AGI is within $50K of the limit, shift income or stack deductions to dip below the line—and do it before December 31st.

Here’s the high-level play: the California SALT deduction cap is not a soft target—it’s binary. Drop $1 under $500,000 AGI and you unlock up to $40,000; go $1 over and you’re slammed back to $10,000. That cliff effect makes proactive October projections the only real defense—waiting until filing season means you’ve already lost the move.

Section 2: Estate and Gift Exemptions — Why Status Quo Means Moving Backward

The new tax law raises federal estate and gift exemptions modestly for 2025—but California residents face another layer: there’s no state estate tax, but trusts can be tripped up by new deduction phase-outs.

2025 Federal Estate Exemption: $13.9 million per individual ($27.8M per married couple). This is up from $12.92M in 2024, and will continue to adjust for inflation.

But fewer California families benefit directly. Most concern comes from Pease limitations creeping back. The original Pease limitation reduced itemized deductions for high-income taxpayers; under OBBBA, a modified version may apply to estates, trusts, and those in the top bracket, further limiting the effectiveness of common trust planning vehicles.

Example: A real estate investor with a $16M estate and $10K in annual charitable giving must now coordinate annual giving and trust distributions more carefully. If the Pease limitation reduces their deduction rate by 3%, that’s an extra $300,000 of income exposed over time—about $120,000 more taxes for the estate (assuming a 40% rate).

The New Rule’s Gray Areas

- Charitable deductions may face new thresholds (floor amounts modeled like medical expenses), so only contributions above a certain % of AGI count.

- For trusts, the highest federal tax rate hits at low-income levels ($14,451 for 2025). The Pease limitation could apply almost immediately.

- “Stacked” strategies, bundling several years’ charitable giving into a donor-advised fund, may be more effective than spreading gifts out annually.

Bottom line: Trust and estate strategies relying on high deduction stacking must be revisited and re-modeled for 2025 onward.

Section 3: AGI Cliffs and New Phase-Outs — Deductions Vanish Without Warning

The 2025 law’s hidden danger is in “cliff” effects. For the first time, several deductions drop suddenly to zero when you exceed an income threshold—not gradually.

- SALT deduction: Cap is $40K up to $500K AGI, returns to $10K above that.

- Charitable and itemized deductions face new Pease-like phase-outs that hit well below traditional HNW levels, especially for estates and trusts.

- Some credits also have new abrupt phase-outs, especially for families with dependents and dual-income households.

Example: A married tech executive in San Jose with $492K AGI considers selling RSUs worth $75K in December. That triggers $567K AGI—he loses $33K of the potential extra SALT deduction, costing him $7,900 in extra tax.

Pro Tip: If your AGI is close to any cliff, “bunch” income and deductions to control exactly which side you land on. Delay sales until January, accelerate deductions, or maximize pre-tax contributions now.

Pro Tip: Use a year-end AGI projection in October. Fill in known W-2s, expected business profits, 1099s, planned asset sales, and check where you land—don’t guess at tax time.

Section 4: Red Flags — The Deductions High Earners Will Miss in 2025

Red Flag Alert: Trusting 2023 or 2024 deduction strategies this year means overpaying by thousands. The 2025 Pease limitation and new “floors” wipe out charitable and itemized breakpoints if you’re just $1 over the threshold—no “phased” reduction.

- Charitable “floor” means first 3-10% of AGI is NOT deductible—only excess qualifies.

- Trust and estate tax brackets compress so quickly that even mid-level trusts hit the 37% rate instantly.

- Many business owners and investors forget to check if AGI-increasing events (like asset sales or deferred comp payouts) push them over a cliff.

- LLC/S Corp owners not proactively tracking year-end profit estimates end up missing huge deduction windows.

What If I Have Multiple Income Sources?

Multiple streams (W-2, 1099, K-1) are all added to your AGI for determining cliff eligibility. If you’re a real estate investor, remember that passive income inclusion and depreciation recapture can spike your AGI unexpectedly.

Section 5: Next Moves — Lock in Savings Before Year-End

If you’re under $500K AGI: “Supercharge” your 2025 return by:

- Bunching property and state tax payments into 2025 to max out the $40K deduction.

- Accelerating charitable giving, health savings account (HSA) contributions, and retirement deferrals to drop AGI under the cliff.

- Considering gifting strategies if your estate exceeds new exemption levels but before potential “sunset” decreases in future years.

For business owners, aligning your entity selection and structure with your expected 2025 AGI can make or break your deduction eligibility. For real estate owners: deploy cost segregation studies now to accelerate depreciation and keep AGI low.

Will the IRS Announce More Changes?

The IRS is actively updating forms, instructions, and software to enforce the new rules efficiently. Expect minor tweaks, but don’t wait—these AGI cliffs and deduction rules are confirmed for the 2025 tax year (see official IRS publications).

KDA Case Study: How a Real Estate Investor Navigated the 2025 SALT and Estate Shift

Derek, a 56-year-old real estate investor based in Southern California, owns a $12 million property portfolio and receives $450,000 a year in rental, K-1, and fee income. In 2024, he defaulted into the $10K SALT deduction cap, missed several $15,000+ deductions through piecemeal charitable giving, and thought his estate plan was rock solid. For 2025, with the guidance of KDA:

- We recalculated his projected AGI in Q3, identifying he’d be under the $500K cliff if he deferred his 4th quarter 1099 consulting payment until January ($38,000 less 2025 AGI).

- Accelerated $23,200 in state tax and property tax prepayments—fully leveraging the $40,000 SALT cap increase.

- Bundled three years’ worth of charitable gifts ($60,000) into a Donor-Advised Fund, bypassing the new charitable “floor” for deductions.

- Tweaked trust distributions to avoid crossing the Pease limitation. We also advised against selling appreciated rental property until his AGI stabilized.

Result: His total 2025 federal tax bill dropped by $18,800, while his estate plan remains flexible for additional gifting before further sunsets. Derek paid $2,950 for the full tax strategy analysis and implementation, netting a 6.3x ROI on KDA advisory for the year.

Frequently Asked Questions

How do I estimate my AGI before year-end?

Gather all current income (W-2, 1099, business profit, asset sales) and project remaining payouts for the year. Use last year’s return as a base, but factor in any planned transactions. Your CPA or KDA strategist can run a tax projection with “what if” scenarios.

Can I bunch multiple years’ deductions or income?

Yes. Especially if you’re close to a deduction cliff, run simulations to see how shifting a bonus, property sale, or charitable gift can swing you below (or above) an AGI threshold. This is highly effective for high earners, business owners, and investors with variable income streams.

Will this trigger an audit?

No, but large year-to-year swings in deductions (especially SALT or charity) may create extra IRS scrutiny. Keep clear records, use clean supporting docs, and file IRS forms on time to stay safe. For complex moves, see the KDA Audit Defense Guide.

Book a Custom California Tax Gameplan

If you’re at risk of missing California’s new deduction windows or want a proactive plan to maximize your savings under the 2025 rules, book a 1-on-1 strategy session with our expert team. Click here to book your tax gameplan session now. We’ll flag every AGI cliff, model your real numbers, and give you 3+ actionable moves you can take before year-end to lock in the biggest possible refund.