The 2025 California Tax Secrets Most Advisors Are Afraid to Explain

The 2025 California Tax Secrets Most Advisors Are Afraid to Explain Most taxpayers believe they’re ‘safe’ if they follow their accountant’s advice and stick with last year’s approach. California tax strategies for 2025, however, are a whole new game—one where confusion equals lost money and overpaid penalties. Federal and state updates have created a shifting […]

2025 California Tax Law Shifts: How Every Taxpayer Can Gain or Lose in the New Era of Compliance

2025 California Tax Law Shifts: How Every Taxpayer Can Gain or Lose in the New Era of Compliance Around $700 million in new penalties and billions in write-offs are on the table for California taxpayers in 2025—and most business owners, W-2s, real estate investors, and LLCs are sleepwalking straight into costly traps. While headlines focus […]

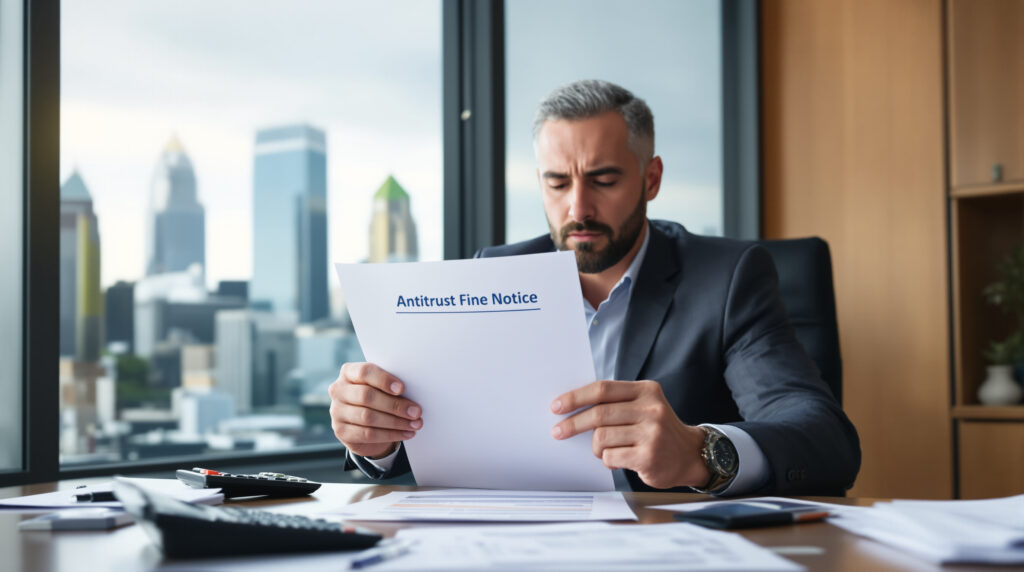

How California Business Owners Can Prepare for Increased Antitrust Fines (and the Tax Impact) in 2025

How California Business Owners Can Prepare for Increased Antitrust Fines (and the Tax Impact) in 2025 California’s new antitrust penalties are about to hit much harder. The maximum criminal penalty for businesses violating the Cartwright Act will jump from $1 million to $6 million—and that’s just one of several compliance changes on the horizon for […]

Short-Term Rental Tax Loophole California: Legally Lower Taxes on Airbnb and Vacation Rentals

Short-Term Rental Tax Loophole California: Legally Lower Taxes on Airbnb and Vacation Rentals California vacation rental hosts and real estate investors are missing a legal tax loophole that could save them $20K or more, even if they only rent out property for part of the year. With new IRS and California rules for 2025, the […]

Proactive Tax Planning vs Reactive Tax Filing: The $18,000 Difference for Small Business Owners and Contractors

Proactive Tax Planning vs Reactive Tax Filing: The $18,000 Difference for Small Business Owners and Contractors Most people believe taxes are just a springtime headache, a compliance chore to survive. Here’s the reality: Reactive tax filing is quietly costing small business owners and 1099 contractors $10,000 or more every single year. The solution? Proactive tax […]

What Irvine Residents Need to Know About Filing Taxes This Year

What Irvine Residents Need to Know About Filing Taxes This Year Irvine tax preparation isn’t just about crunching numbers—this year, the IRS and California both made policy moves that can cost (or save) you thousands, depending on how prepared you are. Did you know it’s possible for a W-2 employee to trigger an audit with […]

Why Most Irvine Taxpayers Overpay: The 2025 Strategy Guide That Changes Everything

Why Most Irvine Taxpayers Overpay: The 2025 Strategy Guide That Changes Everything This information is current as of 9/13/2025. Tax laws change frequently. Verify updates with the IRS or FTB if reading this later. Every year, thousands of Irvine residents and business owners—everyone from W-2 employees in tech campuses to real estate investors in Turtle […]

7 Tax Traps That Cost Irvine Families and Business Owners Thousands in 2025

7 Tax Traps That Cost Irvine Families and Business Owners Thousands in 2025 Irvine tax preparation is more than just plugging numbers into tax software. Every year, thousands of Irvine residents—W-2 employees, freelancers, small business owners, and real estate investors—leave $3,000–$18,000+ on the table. The difference? Strategic, local tax expertise. If you’re even a little […]