Beverly Hills Tax Preparation: Avoid the $20,000 IRS Mistake Affluent Filers Make in 2025

Beverly Hills Tax Preparation: Avoid the $20,000 IRS Mistake Affluent Filers Make in 2025 Beverly Hills tax preparation isn’t just about filling out forms—it’s a financial chess game with real money at stake. Every year, hundreds of high-income earners in 90210 overpay by five or six figures, often out of fear of triggering an IRS […]

The Tax Planning Checklist Every Business Owner Needs for 2025: No Deductions Missed, No Red Flags Raised

The Tax Planning Checklist Every Business Owner Needs for 2025: No Deductions Missed, No Red Flags Raised Tension + Turn Opening: Every year, business owners make the same mistake: They scramble at tax time, miss deductions, and end up writing checks to the IRS that could have padded their bottom line. Worse, a haphazard approach […]

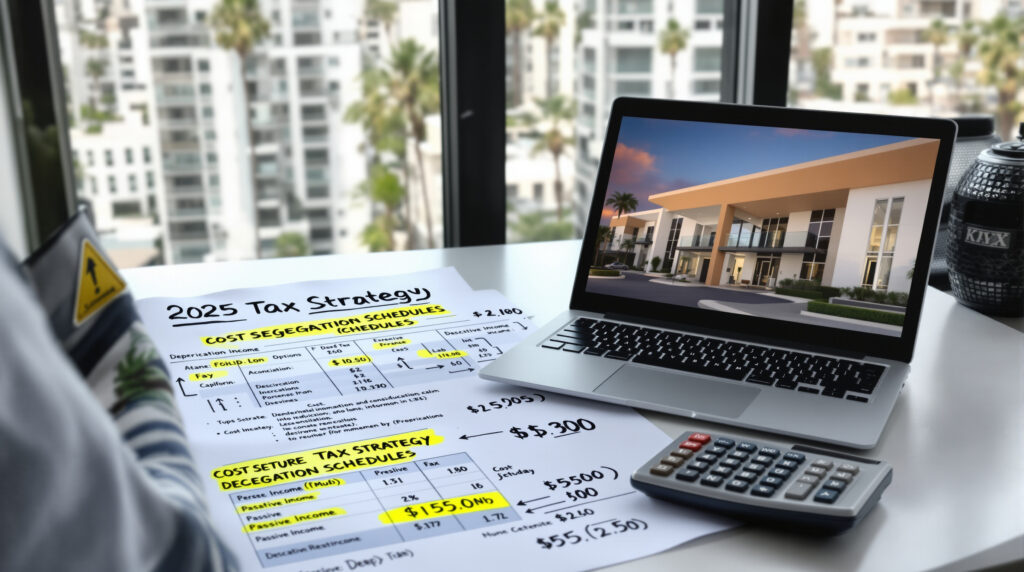

California Real Estate Investors: Hidden Tax Strategies the IRS Won’t Teach You for 2025

California Real Estate Investors: Hidden Tax Strategies the IRS Won’t Teach You for 2025 Most California real estate investors have a tax problem they don’t realize: the IRS rulebook is stacked against them, unless you use advanced, aggressive strategies the average accountant ignores. In a year when tax law shifts and economic uncertainty intersect, savvy […]

Unlocking Passive Wealth: Advanced Tax Moves for California Real Estate Investors in 2025

Unlocking Passive Wealth: Advanced Tax Moves for California Real Estate Investors in 2025 Most real estate investors in California spend years building a rental portfolio, only to watch their net profits vanish from taxes and overlooked deductions. For 2025, new IRS and California rules make the difference between breaking even and stacking up five-figure passive […]

Cost Segregation for Short-Term Rentals in California: The Overlooked $30K Play for Real Estate Investors

Cost Segregation for Short-Term Rentals in California: The Overlooked $30K Play for Real Estate Investors Picture this: A California Airbnb owner claims $1,126 in depreciation. Next door, another host claims $30,700. Both own nearly identical properties. The difference? Cost segregation for short-term rentals in California. This is the hidden lever most property owners and CPAs […]

The Irvine Taxpayer’s Playbook: Maximize Your 2025 Tax Refund Without Fear

The Irvine Taxpayer’s Playbook: Maximize Your 2025 Tax Refund Without Fear Most Irvine residents overpay the IRS every year. It isn’t because they make more mistakes than everyone else—it’s because they play by old, outdated tax rules, or delegate to generic chains that don’t understand the realities of Irvine tax preparation in 2025. This city […]

Smart Tax Moves for Irvine, CA Business Owners: 2025’s Updated Playbook

Smart Tax Moves for Irvine, CA Business Owners: 2025’s Updated Playbook Irvine tax preparation isn’t just about forms and deadlines—it’s about systematically protecting cash flow while staying 100% compliant in one of America’s highest-audit, highest-competition, highest-opportunity markets. Too many Irvine entrepreneurs still pay $5,000–$25,000 more than necessary every year, largely because they don’t understand how […]