2025 California Tax Compliance: Essential Deadlines, Penalties, and the Real Cost of Missing an Audit Trigger

2025 California Tax Compliance: Essential Deadlines, Penalties, and the Real Cost of Missing an Audit Trigger If you’ve ever lost sleep over what the IRS or Franchise Tax Board could throw at your business this year, you’re not alone. Compliance in California isn’t just about filing on time—it’s about knowing the real cost of missing […]

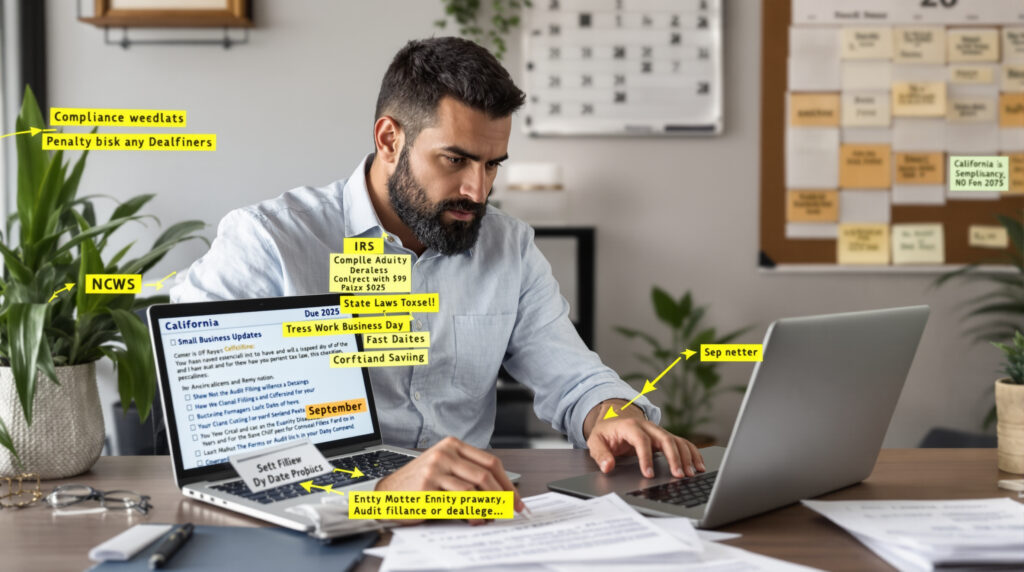

The Compliance Trap: Hidden Costly Mistakes California Business Owners Make in 2025 (And How to Avoid Them)

The Compliance Trap: Hidden Costly Mistakes California Business Owners Make in 2025 (And How to Avoid Them) Published: August 30, 2025 Think your bookkeeping is tight enough to survive an audit in 2025? Statistically, most business owners think so—until the penalties hit. California’s new FTB penalty structure and strict IRS audit algorithm, combined with recent […]

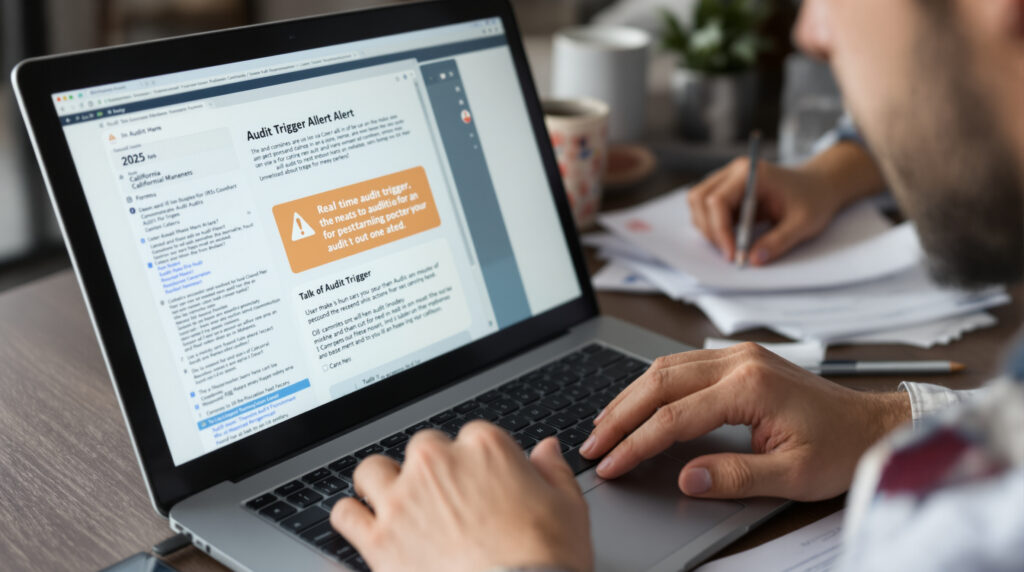

Why IRS Audit Representation Specialists Are Your Best Defense (And What Most Taxpayers Get Wrong)

Why IRS Audit Representation Specialists Are Your Best Defense (And What Most Taxpayers Get Wrong) More than 700,000 U.S. taxpayers face IRS audits each year, but less than 20% secure proper audit defense. Most make costly mistakes that could have been prevented with expert help. If you’ve received an audit letter, your very first move—not […]

The Untold Truth About Estate Tax Rate in California: How High-Net-Worth Families Can Save Millions in 2025

The Untold Truth About Estate Tax Rate in California: How High-Net-Worth Families Can Save Millions in 2025 Most wealthy Californians believe their estate plan is bulletproof. The reality: a single overlooked rule could cost your heirs seven figures in avoidable taxes. For those with substantial assets or multigenerational ambitions, understanding the estate tax rate in […]

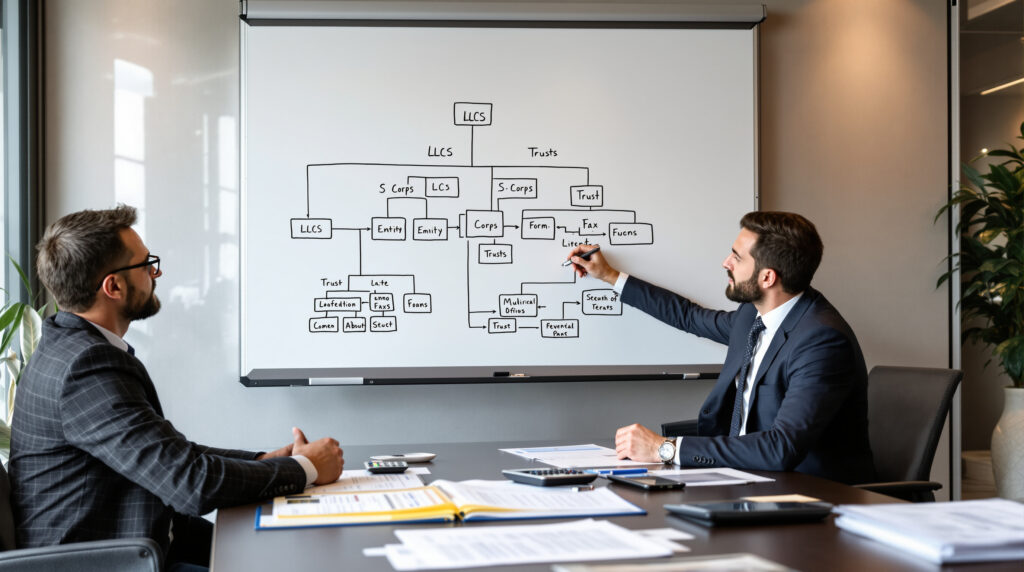

The Overlooked Power of Multi-Entity Tax Planning Strategies: How Advanced Structuring Slashes Taxes for High-Income Earners

The Overlooked Power of Multi-Entity Tax Planning Strategies: How Advanced Structuring Slashes Taxes for High-Income Earners Most successful entrepreneurs, real estate investors, and high-net-worth families overpay taxes—often by $50,000 to $200,000 per year—because traditional advisors only recommend one entity type. The days of “just start an LLC” are done. If you want to build, shield, […]

What Irvine Residents Need to Know About Filing Taxes in 2025: Avoid Overpaying with These Local Strategies

What Irvine Residents Need to Know About Filing Taxes in 2025: Avoid Overpaying with These Local Strategies Most people who call Irvine home expect their accountant to spot every legal write-off, deduction, and recent change. Here’s a hard truth: last year, over 71% of OC taxpayers missed at least one deduction worth $500 or more—because […]

What Irvine, CA Business Owners Miss (and Pay For) When Filing 2025 Taxes

What Irvine, CA Business Owners Miss (and Pay For) When Filing 2025 Taxes Most Irvine business owners leave thousands on the table because they assume federal tax rules are all that matter. But California’s unique twist—especially for those who work, live, or invest in cities like Irvine—means you’re likely missing city-specific savings and exposing yourself […]

The 2025 Guide to Tax Preparation in Dana Point, CA

The 2025 Guide to Tax Preparation in Dana Point, CA Dana Point tax preparation isn’t just about plugging numbers into a software platform and hoping for a refund. In a city as distinct as Dana Point—with its unique mix of families, remote workers, real estate investors, and business owners—the most dangerous myth is that one-size-fits-all […]