Pasadena Tax Prep: 7 Deductions Most People Miss

Pasadena Tax Prep: 7 Deductions Most People Miss Millions of Pasadena taxpayers are leaving thousands on the table every year without ever realizing it. The most common belief? That if you use a reputable tax preparer in California, you must be getting the best possible deal. Here’s the uncomfortable truth: Even in Pasadena, too many […]

Redondo Beach Freelancers: Stop Missing These Tax Write-Offs in 2025

Redondo Beach Freelancers: Stop Missing These Tax Write-Offs in 2025 Redondo Beach freelancers often leave thousands on the table each year by missing deductions or misreporting their 1099 income. The IRS doesn’t do you any favors—but a well-prepared return can mean the difference between a painful surprise bill and a strategic refund. For the 2025 […]

Why Estate Tax Rate California Strategies Matter: Protecting Your Legacy in 2025

Why Estate Tax Rate California Strategies Matter: Protecting Your Legacy in 2025 Most high-net-worth Californians are convinced estate taxes won’t touch their family. The reality? A single misstep with state-federal thresholds could cost your heirs $2 million or more in lost assets—especially given recent regulatory swings and looming repeal threats. California currently has no standalone […]

California Estate Tax 2025: Strategies for High-Net-Worth Families to Safeguard Their Legacy

California Estate Tax 2025: Strategies for High-Net-Worth Families to Safeguard Their Legacy Here’s the reality: California’s estate tax comes roaring back in policy debates, and high-net-worth families ignore it at their peril. With rising asset values and D.C. uncertainty, not having a plan exposes millions—if not tens of millions—in unnecessary taxation. Yet even as headlines […]

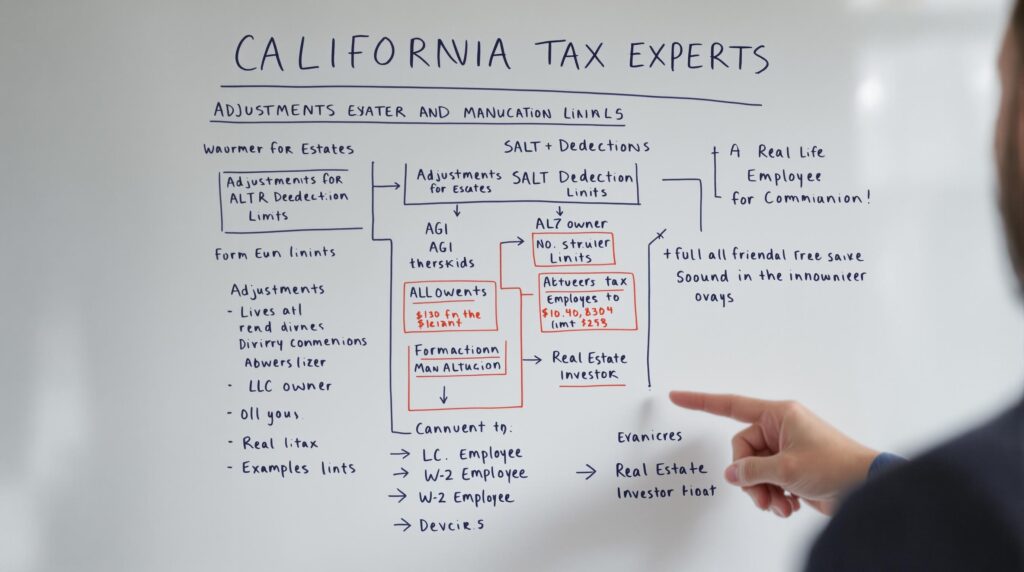

California’s 2025 Tax Law Shakeup: How the $40K SALT Cap and Estate Changes Will Rewrite Your Savings Plan

California’s 2025 Tax Law Shakeup: How the $40K SALT Cap and Estate Changes Will Rewrite Your Savings Plan 8/16/2025 — Too many high-earners are still in the dark about a rule that could wipe out a five-figure deduction overnight. The new $40,000 SALT cap for sub-$500K AGI households, slippery Pease limits for trusts, and gift/estate […]

2025 California SALT Deduction, Estate Limits, and AGI Cliffs: How Real Taxpayers Will Win (or Lose) Under the New Rules

2025 California SALT Deduction, Estate Limits, and AGI Cliffs: How Real Taxpayers Will Win (or Lose) Under the New Rules California taxpayers are on the edge of major tax law shifts, but most don’t realize this year’s changes are designed to quietly shift the tax burden onto the unsuspecting. High-earning business owners, W-2 employees, and […]